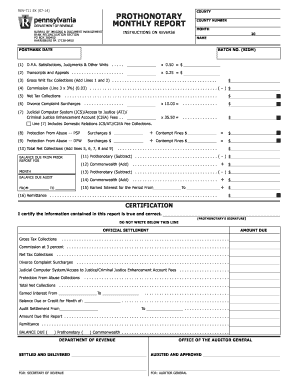

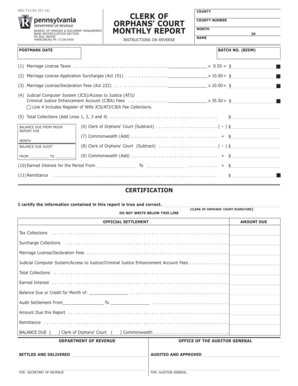

Monthly Bank Reconciliation

What is monthly bank reconciliation?

Monthly bank reconciliation is the process of comparing and matching the transactions recorded in your company's bank statement with the transactions recorded in your company's accounting records. This process helps ensure the accuracy and integrity of your financial data by identifying discrepancies and errors.

What are the types of monthly bank reconciliation?

There are two types of monthly bank reconciliation:

Internal Bank Reconciliation

External Bank Reconciliation

How to complete monthly bank reconciliation

To complete monthly bank reconciliation, follow these steps:

01

Gather the necessary documents, including your bank statement and accounting records.

02

Compare the transactions listed on your bank statement with those in your accounting records.

03

Identify and document any discrepancies or errors.

04

Investigate and resolve any discrepancies or errors.

05

Update your accounting records to reflect the correct information.

06

Reconcile your ending bank balance with your accounting records.

07

Document the reconciliation process for future reference.

By following these steps, you can ensure the accuracy of your financial data and maintain the integrity of your accounting records.

Video Tutorial How to Fill Out monthly bank reconciliation

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I do a bank reconciliation in Excel?

Below is step by step procedure for Bank Reconciliation: Match the Opening balance as per Bank statement with the books. Check and tick all the debit entries as reflected in bank ledger with the credit entries in Bank Statement, identify which are missed.

How do you reconcile monthly bank statements?

How to reconcile a bank statement Receive Bank Statement. Match Book Deposits to Statement. Match Bank Deposits to Book. Adjust Deposit Record or Contact the Bank. Match Bank Checks to Book. Identify Uncleared Checks. Review Miscellaneous Bank Items. Summarize Reconciling Items.

How do you format a bank reconciliation statement?

Bank Reconciliation Procedure On the bank statement, compare the company's list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks.

What is a monthly bank reconciliation?

A bank reconciliation is a process of matching the balances in a business's accounting records to the corresponding information on a bank statement. The goal of the bank reconciliation process is to find out if there are any differences between the two cash balances.

What 3 items do you need to reconcile your bank statement?

There are three steps: comparing your statements, adjusting your balances, and recording the reconciliation. Step one: Comparing your statements. Step two: Adjusting your balances. Step three: Recording the reconciliation.

What are the steps in preparing a monthly bank reconciliation?

Bank reconciliation steps Get bank records. You need a list of transactions from the bank. Get business records. Open your ledger of income and outgoings. Find your starting point. Run through bank deposits. Check the income on your books. Run through bank withdrawals. Check the expenses on your books. End balance.

Related templates