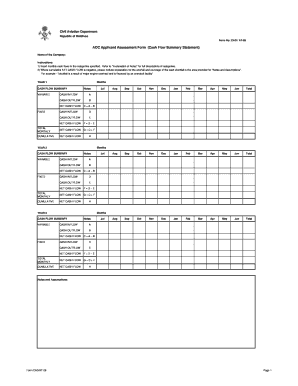

What is monthly cash flow template?

A monthly cash flow template is a tool that helps individuals or businesses track their incoming and outgoing cash. It provides an overview of the cash flow for a specific month, including income, expenses, and any changes in cash reserves. This template allows users to have a clear understanding of their financial situation and make informed decisions regarding their cash flow management.

What are the types of monthly cash flow template?

There are several types of monthly cash flow templates available, each catering to different needs and preferences. Some common types include:

How to complete monthly cash flow template

Completing a monthly cash flow template is a simple and effective process. Here are the steps to follow:

By using pdfFiller, you can easily create, edit, and share your monthly cash flow templates online. With unlimited fillable templates and powerful editing tools, pdfFiller provides everything you need to effectively manage your cash flow and financial documentation.