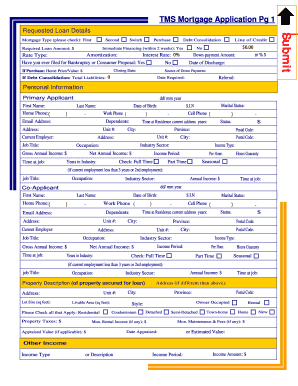

What is mortgage amortization calculator?

A mortgage amortization calculator is a helpful tool that allows individuals to determine the amount of principal and interest they will pay over the term of their mortgage. By inputting key details such as loan amount, interest rate, and term length, the calculator produces a comprehensive schedule outlining how each payment is allocated between principal and interest.

What are the types of mortgage amortization calculator?

There are several types of mortgage amortization calculators available for different purposes. Some common types include:

Basic Mortgage Amortization Calculator: This type calculates the amortization schedule based on the loan amount, term, and interest rate.

Extra Payment Mortgage Calculator: This calculator helps determine the impact of making additional payments towards the principal, reducing the overall interest paid and shortening the loan term.

Bi-Weekly Mortgage Calculator: This calculator calculates the savings and accelerated payoff of a bi-weekly payment plan, which involves making half the monthly payment every two weeks.

Adjustable Rate Mortgage (ARM) Calculator: This calculator is designed specifically for adjustable-rate mortgages, allowing borrowers to estimate their mortgage payments based on different interest rate scenarios.

Reverse Mortgage Calculator: This type of calculator is used to estimate the loan amount available for a reverse mortgage, considering factors such as the borrower's age, property value, and interest rates.

How to complete mortgage amortization calculator

Completing a mortgage amortization calculator is a straightforward process. Follow these steps:

01

Enter the loan amount: Input the total amount borrowed from the lender for your mortgage.

02

Specify the interest rate: Enter the annual interest rate assigned to your mortgage.

03

Choose the loan term: Determine the length of time (in years or months) you will take to repay the mortgage.

04

Enter the start date: Provide the date when the mortgage will begin or started.

05

Add any additional payments: If you plan to make extra payments towards the principal, include them in the calculator to see the impact on the amortization schedule.

06

Calculate the results: Click on the calculate button to generate the amortization schedule.

With pdfFiller, users can effortlessly create, edit, and share documents online. With access to unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for getting your documents done efficiently and effectively.