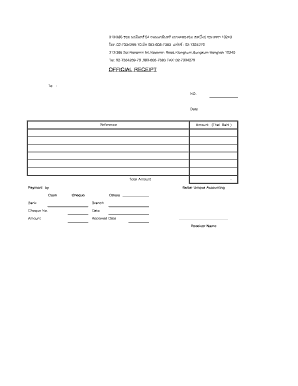

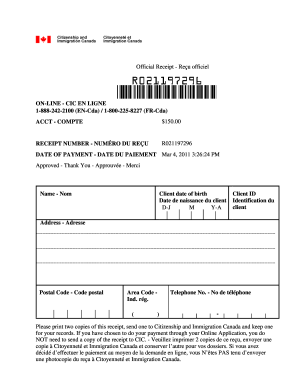

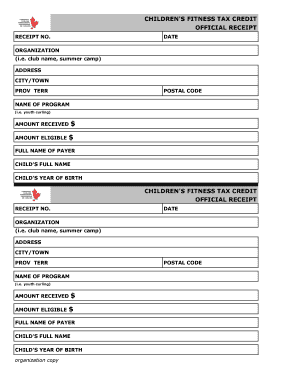

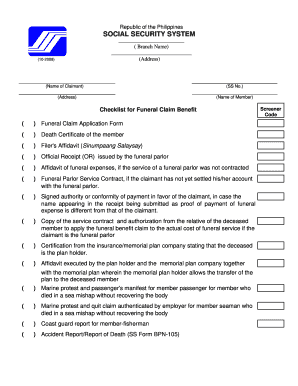

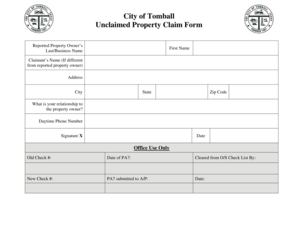

Official Receipt Form

Some reasons for the creation of the official payment receipt

Nowadays every person tries to manage their time and decrease everything that takes extra minutes. The usage of receipts is extremely important for those who want to organize their business workflow.

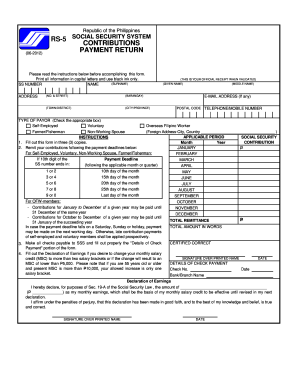

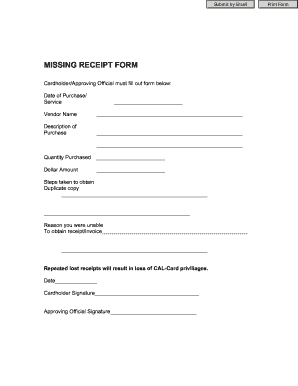

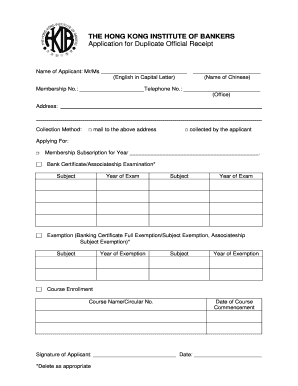

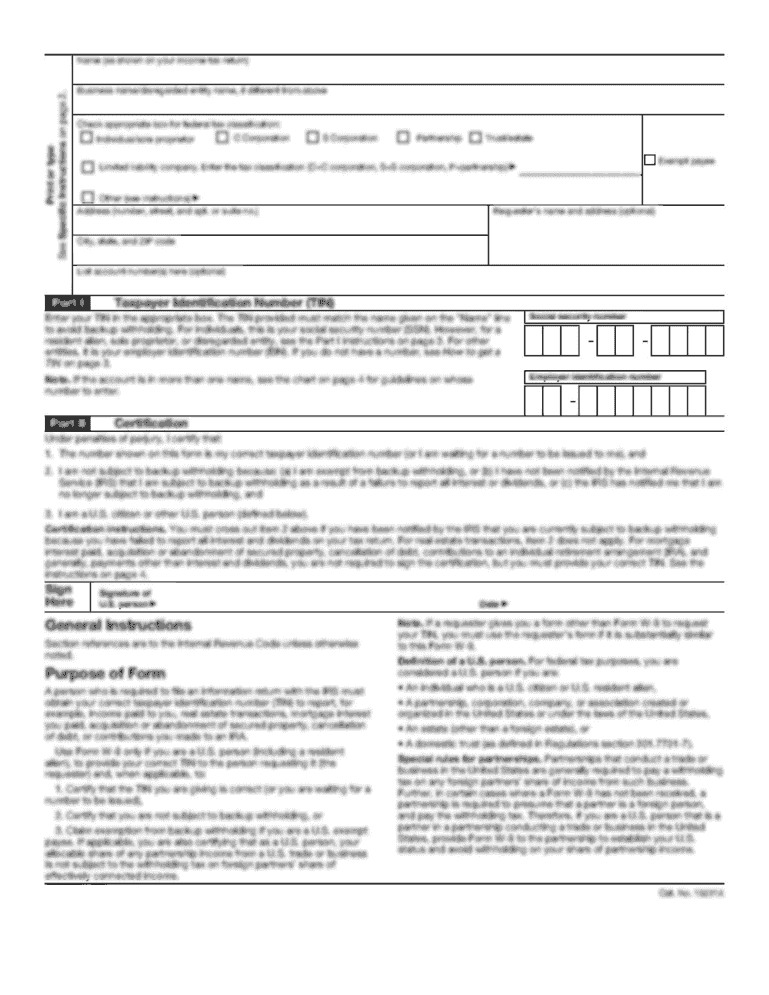

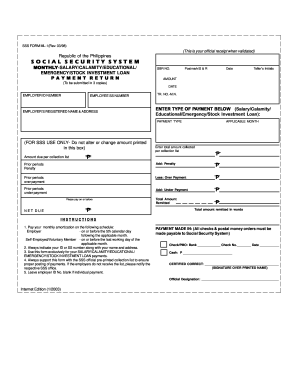

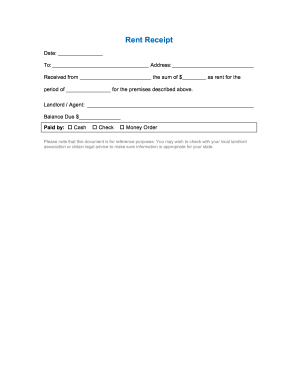

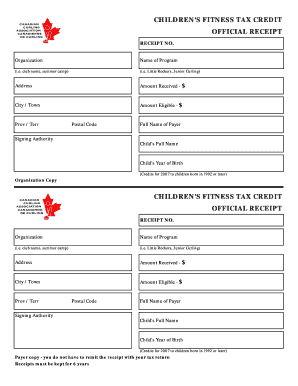

The official receipts are usually provided to the customers after the time they payed for some goods or services. However, more often we are buying goods and pay tax collections in the online with a credit card. In such cases electronic receipt is obligatory. When the user fills out some governmental form or application they need to pay the additional tax and provide the template together with the other necessary documents.

The issuing of the payment receipt is extremely important for every company or organization that provides services, sells goods or makes banking operations. If you want to create your own payment sample, use one of the blanks, provided in PDFfiller library or upload the existing one to your personal account.

How to complete the official payment receipt

Users may upload the necessary PDF file from the internal storage of their computer or mobile device. In addition to that, it’s possible to import the document from the cloud storage or third-party connections.

Fill out the template in a few minutes using these simple instructions: