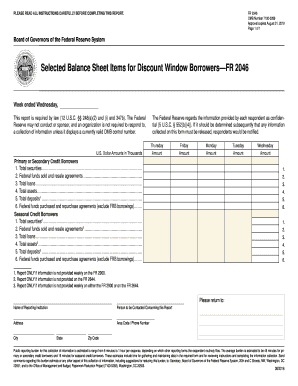

Opening Balance Sheet After Acquisition

What is opening balance sheet after acquisition?

The opening balance sheet after acquisition is a financial statement that shows the assets, liabilities, and equity of a company at the beginning of its operations after being acquired by another company. It provides a snapshot of the company's financial position and is an important tool for assessing its value and potential future growth.

What are the types of opening balance sheet after acquisition?

There are two main types of opening balance sheet after acquisition:

Consolidated Opening Balance Sheet: This type of balance sheet combines the financial information of both the acquiring and acquired companies. It reflects the combined assets, liabilities, and equity of the newly formed entity.

Separate Opening Balance Sheet: This type of balance sheet displays the financial information of the acquired company as a separate entity from the acquiring company. It highlights the assets, liabilities, and equity specific to the acquired company.

How to complete opening balance sheet after acquisition

Completing the opening balance sheet after acquisition requires attention to detail and accuracy. Here are the steps to follow:

01

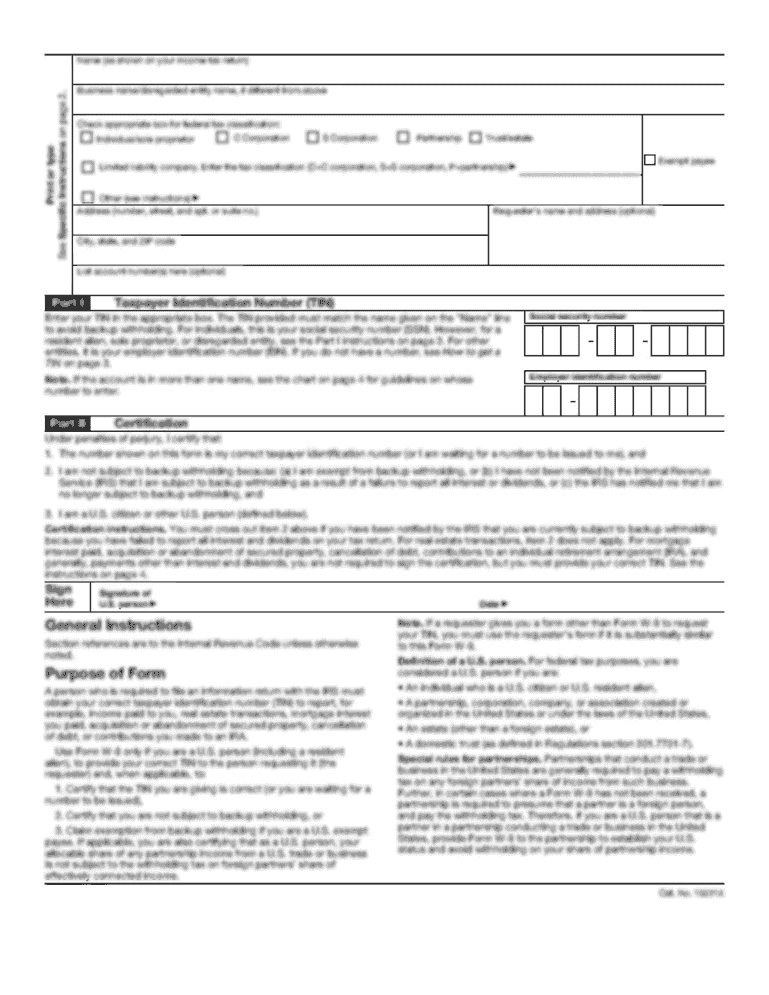

Gather financial information: Collect all relevant financial data of both the acquiring and acquired companies, including balance sheets, income statements, and cash flow statements.

02

Consolidate or separate financial data: Depending on the type of opening balance sheet you are preparing, consolidate the financial data of both companies or keep them separate.

03

Adjust for fair value: If necessary, make adjustments to account for fair value of assets or liabilities. This may involve revaluing assets or recognizing any goodwill.

04

Prepare balance sheet: Use the gathered and adjusted financial data to prepare the opening balance sheet, ensuring all assets, liabilities, and equity are accurately represented.

05

Review and verify: Double-check all entries and calculations to ensure accuracy. Verify that the opening balance sheet complies with accounting standards and reflects the true financial position.

06

Include supporting documentation: Attach any necessary supporting documentation, such as financial statements and valuation reports, to provide transparency and support the figures presented.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out opening balance sheet after acquisition

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the opening balance of a new business?

At the start of any business, the opening balance is zero. As the business moves forward the amount spent by the business and the amount owned by the business are added to that balance to create a closing balance at the end of the first designated accounting period.

How do you create an opening balance sheet for a new business?

How to Create an Opening Balance Sheet for a New Business Write out every asset of the company and how much each asset is worth. Write out any debt your company currently has in relation to the assets. Subtract your total liabilities from your assets to calculate your owner's equity.

How do you record an asset acquisition?

Acquisition: Accounting for Purchase of Fixed Assets To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount.

What happens to balance sheet after merger?

The acquiring company can restructure the balance sheet of the target entity soon after a merger or acquisition to eliminate some of its burdensome obligations. For example, a target entity that has issued too many shares brings about the burdens of diluted dividends and unstable stock prices.

How do you create a balance sheet for a new business?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

Which financial statement shows acquisitions?

“Acquisitions, Net of Cash Acquired” is a common line on the Cash Flow Statement. It measures the net amount of cash a company spent to acquire other companies. For example, suppose a company's Cash Flow Statement shows $500 million for “Acquisitions, Net of Cash Acquired”.

Related templates