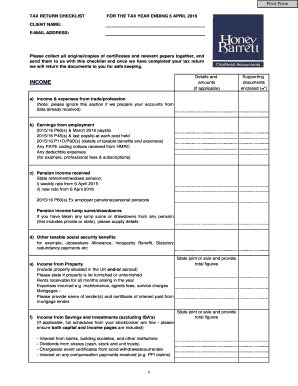

P45 Form

General Information about the P45 Form

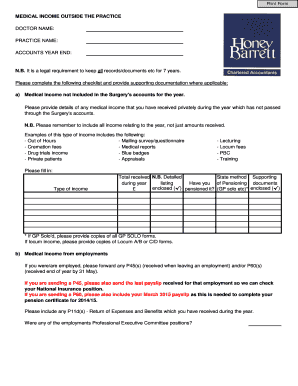

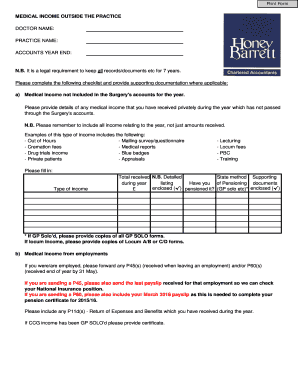

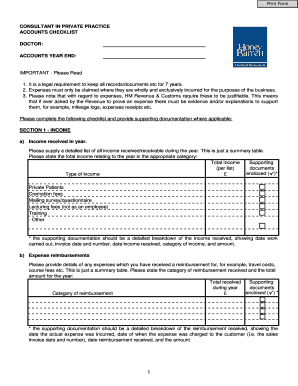

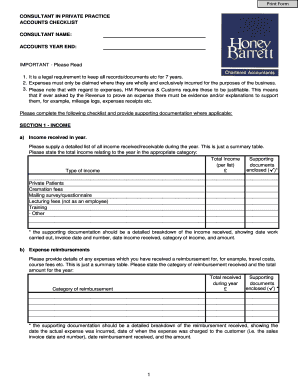

The P45 sample is filed by representatives of previous and new companies. The major part is filed by the previous organization. It is completed in capital letters to improve readability.

The document contains the following information:

The template is available for e-filing directly to the HM Revenue and Customs.

Who Files the P45 Template?

Form P45 is filled out by the employer when the employee leaves work. It has four pages and each one has its own separate aim. The first page needs to be filed to Her Majesty's Revenue and Customs Department right after the person leaves the company. It is necessary to correctly count and collect taxes from the employee. Three other copies go to the employee and further on this person is responsible for keeping templates for further processing. The second and third parts are used in the new place of employment. One of them is used to request a tax credit certificate at the newly employed company. Part four can be used in case the jobseeker's benefits are needed.

In case of the death of an employee, the company should complete all four template pages and send all of them to the HM Revenue Department. Those who relocate to a country outside the UK should also complete the P85 form. Individuals who want to become self-employed should apply to the HMRD within three months to complete all supporting documents or they will have to pay penalties.