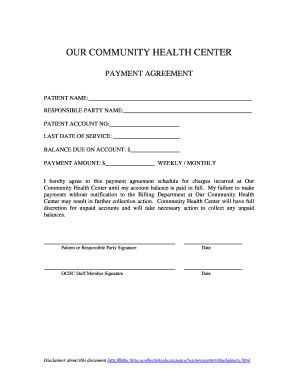

What is payment schedule sample?

A payment schedule sample is a document that outlines the dates and amounts of payments that are required to be made for a particular project or service. It is a useful tool for both parties involved in a transaction to ensure that payments are made on time and in the agreed-upon amounts. Payment schedule samples can be used in various industries, such as construction, freelance work, or rental agreements.

What are the types of payment schedule sample?

There are several types of payment schedule samples that can be used depending on the nature of the transaction. Some common types include:

Milestone Payment Schedule - This type of payment schedule is based on the completion of specific milestones or stages of a project. Payments are made at key points outlined in the schedule.

Installment Payment Schedule - This type of payment schedule breaks down the total payment into equal installments over a specific period of time. Payments are made at regular intervals, such as monthly or quarterly.

Progress Payment Schedule - This type of payment schedule is commonly used in construction projects. Payments are made based on the progress of the project, usually determined by completed tasks or percentage completion.

Retainer Payment Schedule - In this type of payment schedule, a certain amount of money is paid upfront as a retainer fee, and the remaining balance is paid upon completion of the project or service.

How to complete payment schedule sample

Completing a payment schedule sample is a straightforward process that requires attention to detail and accuracy. Here are the steps to follow:

01

Gather all the necessary information - Make sure you have all the details of the project or service agreement, including the payment terms, dates, and amounts.

02

Fill in the payment schedule template - Use a payment schedule template or create one from scratch using a spreadsheet or word processing software. Enter the necessary information in the appropriate fields.

03

Double-check the calculations - Ensure that all the calculations for the dates and amounts are correct. Verify that the total payment matches the agreed-upon amount.

04

Review and revise if necessary - Take the time to review the completed payment schedule sample for any errors or discrepancies. Make revisions if needed to ensure accuracy.

05

Save and share the payment schedule - Once you are satisfied with the completed payment schedule sample, save it in a secure location and share it with the relevant parties involved in the transaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.