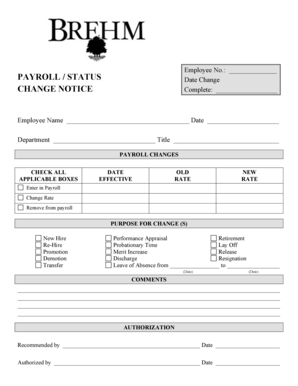

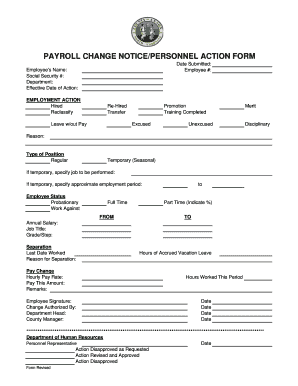

Payroll Change Notice

What is payroll change notice?

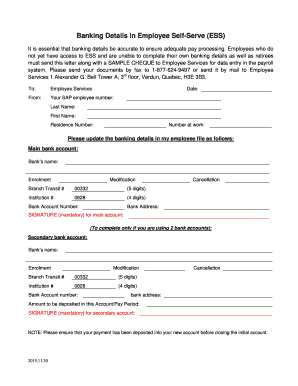

A payroll change notice is a document that is used to inform employees of any changes in their pay. It serves as a formal notification to employees regarding modifications in their salary, wage rates, tax withholdings, deductions, or any other payroll-related information. This notice is an essential tool in ensuring transparency and accuracy in the payroll process, as it provides employees with detailed information about any changes that may affect their compensation.

What are the types of payroll change notice?

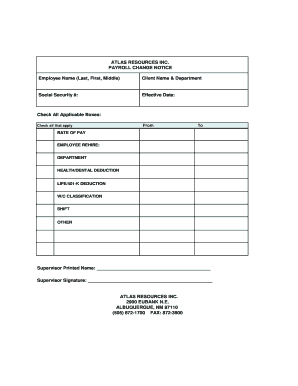

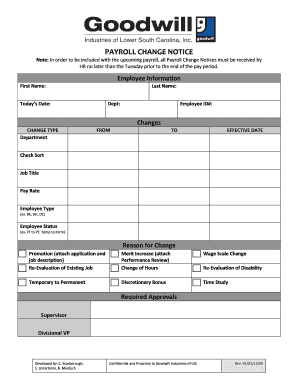

There are several types of payroll change notices that organizations may use depending on the nature of the change. Some common types include: 1. Salary/Wage Change Notice: This notice informs employees about changes in their salary or wage rates. 2. Tax Withholding Change Notice: This notice provides information about any changes in tax withholding rates or allowances. 3. Deduction Change Notice: This notice notifies employees about changes in the deductions made from their pay, such as health insurance premiums or retirement contributions. 4. Position Change Notice: This notice is used to inform employees about changes in their job position or title that may impact their pay or benefits. These are just a few examples, and the specific types of payroll change notices may vary depending on the organization and its policies.

How to complete payroll change notice

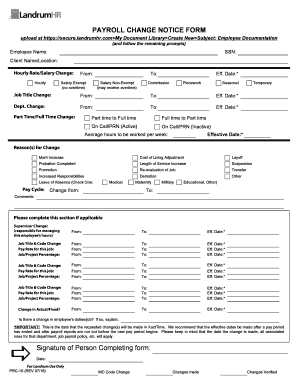

Completing a payroll change notice is a straightforward process that requires attention to detail. Follow these steps to ensure accurate completion: 1. Provide Employee Information: Start by entering the employee's full name, employee ID number, and contact details. 2. Specify Change Type: Indicate the type of change being made, such as salary/wage change, tax withholding change, or deduction change. 3. Enter Effective Date: Enter the effective date of the change, which is the date from which the new payroll details will come into effect. 4. Provide Details: Provide all the necessary details related to the change, such as the new salary/wage rate, tax withholding percentage, or deduction amount. 5. Verify and Sign: Double-check all the information provided for accuracy and sign the payroll change notice. If required, obtain the employee's signature as well. By following these steps, you can ensure that the payroll change notice is completed accurately and efficiently.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.