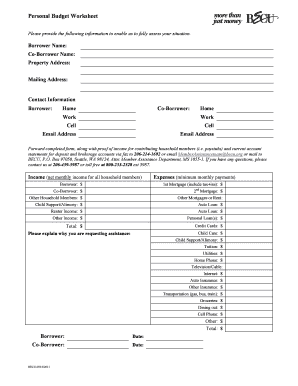

What is Personal Budget Worksheet?

A Personal Budget Worksheet is a tool that helps individuals track and manage their income and expenses. It is a detailed plan that allows you to organize and allocate your financial resources effectively. By using a Personal Budget Worksheet, you can gain a clear understanding of your financial situation and make informed decisions about where to allocate your money.

What are the types of Personal Budget Worksheet?

There are various types of Personal Budget Worksheets available to cater to different needs and preferences. Some common types include:

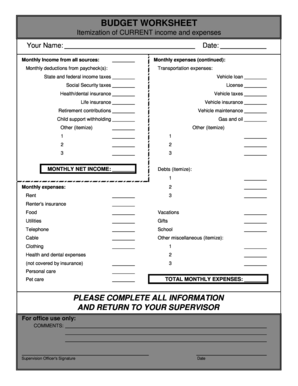

Monthly Budget Worksheet: This type of worksheet helps you track your monthly income and expenses. It allows you to categorize your expenses and analyze your spending habits.

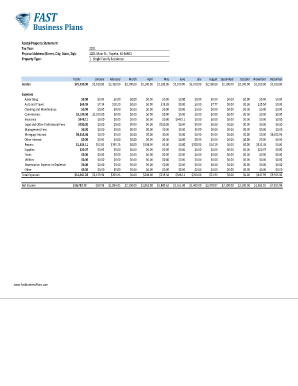

Annual Budget Worksheet: This worksheet helps you plan your finances for an entire year. It allows you to set long-term financial goals and monitor your progress throughout the year.

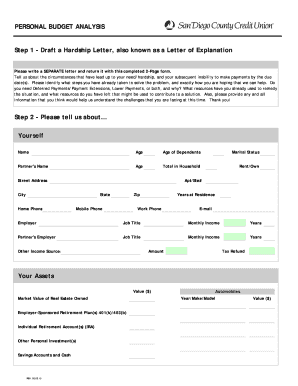

Debt Payoff Worksheet: If you have debts, this type of worksheet can help you create a plan to pay them off. It allows you to prioritize your debts and allocate your resources towards debt repayment.

Savings Goal Worksheet: This worksheet is useful for setting and tracking savings goals. It helps you stay focused and motivated to achieve your financial objectives.

Expense Tracking Worksheet: If you want to gain a better understanding of your daily expenses, an expense tracking worksheet can be helpful. It allows you to record and categorize your expenses to identify areas where you can cut back or make adjustments.

How to complete Personal Budget Worksheet

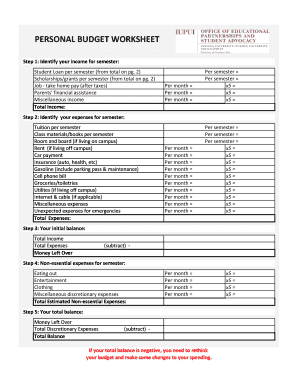

Completing a Personal Budget Worksheet is simple and can be done in a few easy steps:

01

Gather all your financial documents, such as bank statements, pay stubs, and bills.

02

List all your sources of income, including your salary, freelance work, or investment earnings.

03

Record all your expenses, both fixed (rent, utilities, etc.) and variable (groceries, entertainment, etc.).

04

Categorize your expenses into different categories, such as housing, transportation, and leisure.

05

Calculate your total income and total expenses to determine your net cash flow.

06

Analyze your budget and identify areas where you can make adjustments or cut back expenses.

07

Set financial goals and allocate your resources accordingly.

08

Regularly review and update your Personal Budget Worksheet to track your progress and make necessary changes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.