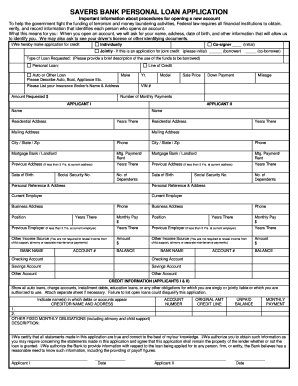

What is personal loan agreement doc?

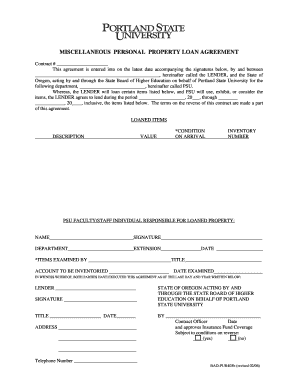

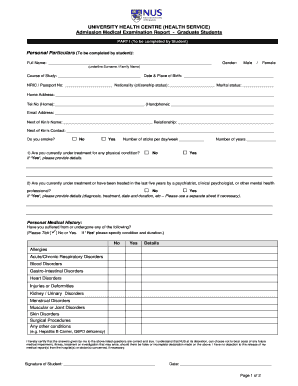

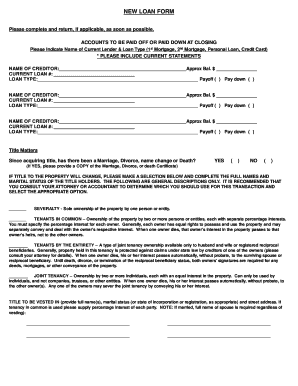

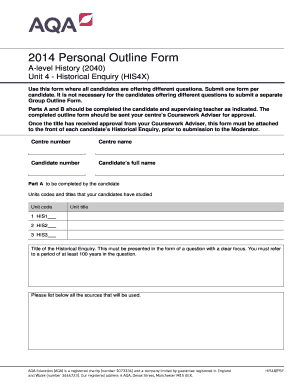

A personal loan agreement doc is a legally binding document that outlines the terms and conditions of a personal loan between a lender and a borrower. It includes details such as the loan amount, interest rate, repayment schedule, and any additional fees or charges. This document serves to protect both parties and ensures that they are aware of their rights and responsibilities.

What are the types of personal loan agreement doc?

There are several types of personal loan agreement documents available, each designed to suit different circumstances. Some common types include:

Unsecured personal loan agreement doc: This type of agreement does not require any collateral and is based solely on the borrower's creditworthiness.

Secured personal loan agreement doc: This agreement involves the borrower providing collateral, such as a car or property, which the lender can seize if the borrower defaults on the loan.

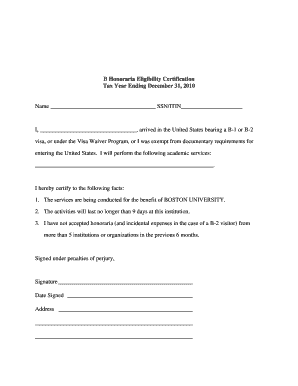

Cosigned personal loan agreement doc: With this type of agreement, a third party, known as a cosigner, joins the borrower in taking responsibility for the loan. The cosigner guarantees repayment in case the borrower is unable to fulfill their obligations.

Payday loan agreement doc: This short-term loan agreement is typically for small amounts and requires the borrower to repay the loan in full, along with high interest, on their next payday.

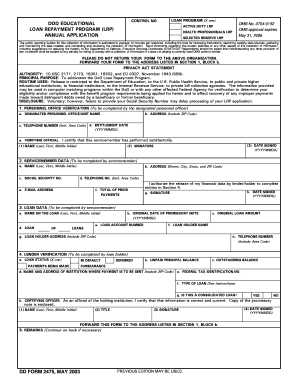

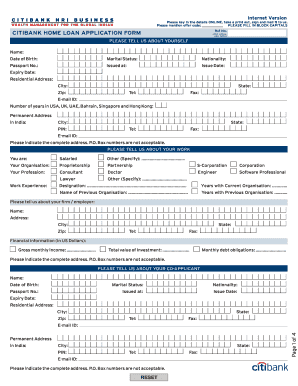

How to complete personal loan agreement doc

Completing a personal loan agreement doc is a straightforward process. Here are the steps involved:

01

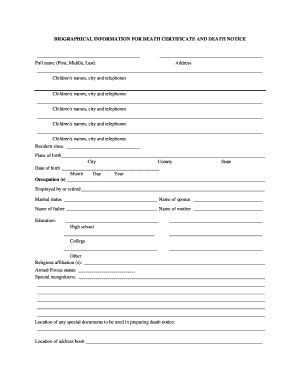

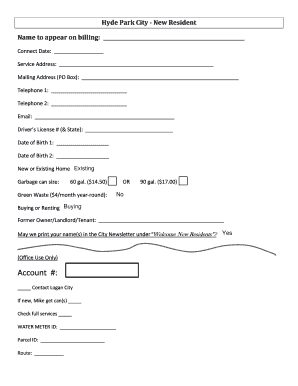

Gather all the necessary information: Make sure you have all the required details, such as the names and addresses of both the lender and borrower, the loan amount, interest rate, repayment terms, and any additional provisions.

02

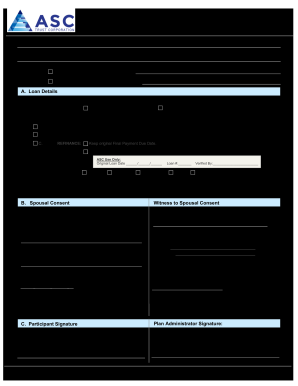

Fill in the blanks: Use a reliable online platform like pdfFiller to easily fill in the required information. pdfFiller provides unlimited fillable templates and powerful editing tools, making it simple to complete your personal loan agreement doc.

03

Review and revise: Once you've filled in the necessary information, carefully review the document to ensure accuracy and clarity. Make any revisions or corrections as needed.

04

Sign and date: Both the lender and borrower should sign and date the personal loan agreement doc to make it legally binding. Consider having a witness or notary present to further validate the document.

05

Keep copies: Each party should keep a copy of the signed personal loan agreement doc for their records. This will serve as proof of the agreed-upon terms and conditions.

When it comes to creating, editing, and sharing documents online, pdfFiller is the ideal solution. With its unlimited fillable templates and powerful editing tools, pdfFiller empowers users to easily create professional-looking personal loan agreement docs. Save time and effort by using pdfFiller as your go-to PDF editor.