Pmi Calculator

What is pmi calculator?

A pmi calculator is a tool that helps determine the amount of private mortgage insurance (PMI) that a borrower would need to pay. PMI is typically required when a borrower makes a down payment of less than 20% of the home's purchase price.

What are the types of pmi calculator?

There are different types of pmi calculators available, including:

Basic PMI Calculator: This type of calculator allows users to input the loan amount, down payment, and interest rate to calculate the monthly PMI payment.

Advanced PMI Calculator: This type of calculator takes into account additional factors such as credit score, property location, and loan term to provide more accurate PMI calculations.

PMI Calculator with Amortization Schedule: This calculator not only calculates the PMI payment but also provides an amortization schedule, showing the breakdown of monthly payments and remaining loan balance over time.

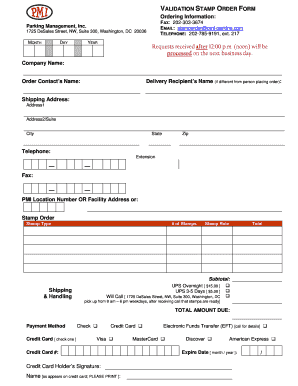

How to complete pmi calculator

Completing a pmi calculator is easy and straightforward. Just follow these steps:

01

Enter the loan amount: Input the total amount of the loan you're considering.

02

Provide the down payment: Enter the amount you plan to put down as a down payment.

03

Enter the interest rate: Input the interest rate for the loan term.

04

Select the loan term: Choose the length of time for repaying the loan, such as 15 or 30 years.

05

Input other required information: Depending on the type of pmi calculator, you may need to provide additional details like credit score or property location.

Once you've entered all the necessary information, the pmi calculator will calculate the monthly PMI payment and provide any other relevant details based on the type of calculator being used.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

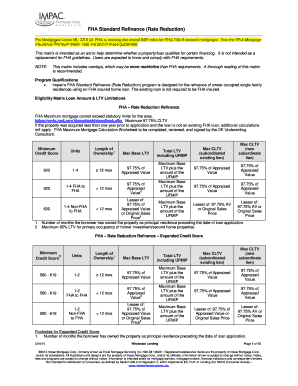

How much is PMI insurance on a $300000 mortgage?

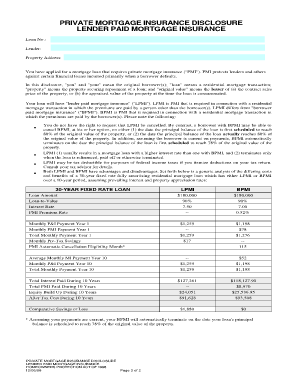

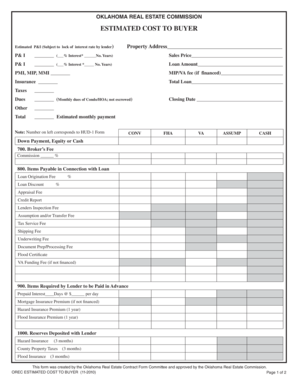

On a $300,000, home with a 30-year fixed rate mortgage: 5% Down Payment20% Down PaymentMonthly Mortgage Payment (Principal & Interest Only)$1,360$1,118PMI (0.99% of Loan)$235/MonthNo PMI RequiredTotal PMI Cost$21,983N/ATotal Monthly Payment*$1,595$1,1183 more rows • Mar 1, 2022

What is the expected down payment on a $300000 house to avoid PMI?

If you want to avoid private mortgage insurance (PMI) you need 20% down. But you may find lenders that allow you to borrow a second mortgage to bridge the gap between your savings and that 20%. More on that below.

How do I calculate PMI?

Take the PMI percentage your lender provided and multiply it by the total loan amount. If you don't know your PMI percentage, calculate for the high and low ends of the standard range. Use 0.22% to figure out the low end and use 2.25% to calculate the high end of the range. The result is your annual premium.

How much is PMI if you put down 15%?

How much does PMI cost? Down payment5% down15% downMonthly PMI payment$300$78Monthly mortgage payment (principal, interest and PMI)$1,660$1,295 Sep 20, 2022

Related templates