Printable Expense Report

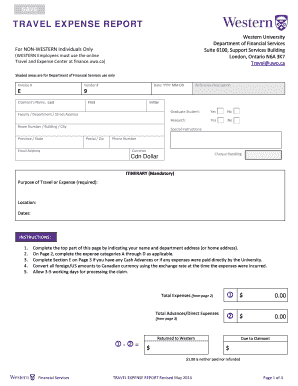

What is a printable expense report?

A printable expense report is a document used to track and record expenses incurred by an individual or company. It provides a detailed breakdown of all expenses, including the date, description, and amount. This report is essential for budgeting and accounting purposes, as it allows for accurate tracking of expenses and helps identify any areas where adjustments can be made.

What are the types of printable expense reports?

There are several types of printable expense reports that cater to different needs and requirements. Some common types include:

How to complete a printable expense report

Completing a printable expense report is a straightforward process that requires attention to detail. Here are the steps to follow:

With pdfFiller, completing a printable expense report becomes even more convenient. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.