Private Placement Memorandum Vs Offering Memorandum

What is private placement memorandum vs offering memorandum?

Private placement memorandum (PPM) and offering memorandum are both legal documents used in fundraising efforts. They provide potential investors with essential information about a company or investment opportunity. However, there are some differences between the two. Private placement memorandum is a document that outlines the terms and conditions of a private offering of securities. It is typically used in offerings that are exempt from registration with the Securities and Exchange Commission (SEC). PPMs provide detailed information about the company, including its business plan, financial projections, and risks involved. They are used to solicit investment from a select group of accredited investors. On the other hand, an offering memorandum is a similar document used in public offerings. It is required by the SEC for companies that are conducting a registered public offering of securities. Offering memorandums contain similar information as PPMs, but they are made available to a wider range of potential investors.

What are the types of private placement memorandum vs offering memorandum?

Private placement memorandums and offering memorandums can vary depending on the specific needs of the fundraising effort. Some common types include: 1. Equity-based PPM or offering memorandum: This type of document is used when offering shares or ownership stakes in a company in exchange for investment. 2. Debt-based PPM or offering memorandum: In this case, the company is seeking to raise funds through debt instruments such as bonds or promissory notes. 3. Hybrid PPM or offering memorandum: This type combines elements of equity and debt financing, offering both ownership stakes and debt instruments to investors.

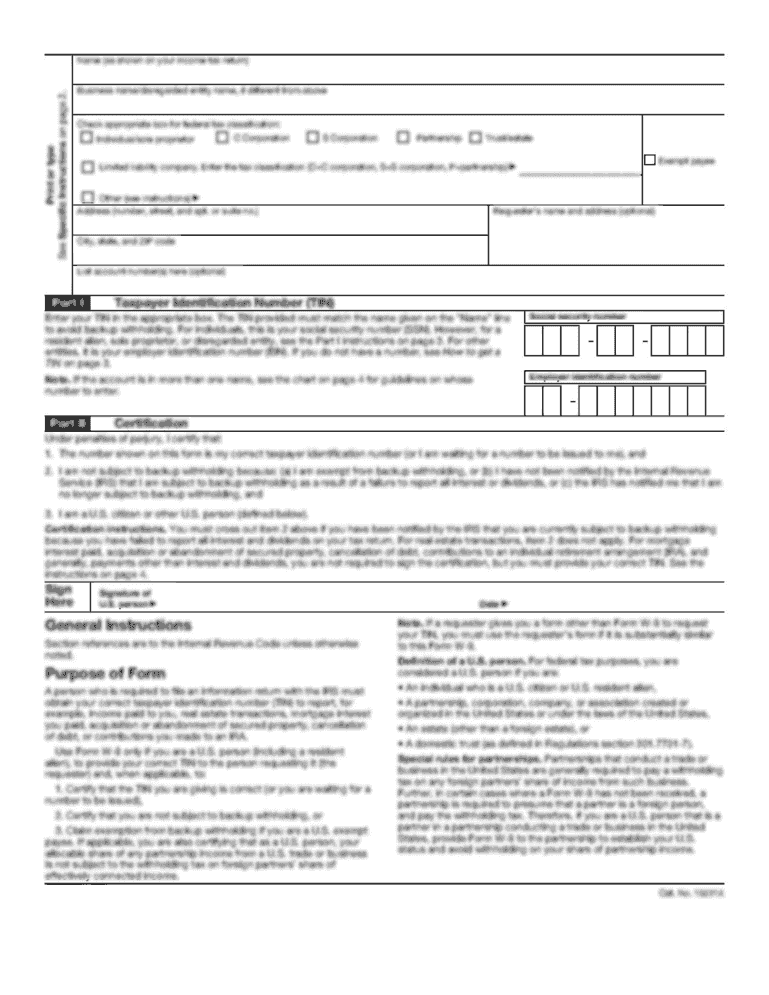

How to complete private placement memorandum vs offering memorandum

Completing a private placement memorandum or offering memorandum requires careful attention to detail and accuracy. Here are some steps to follow: 1. Start with a template: Using a template can save time and ensure that all necessary information is included. pdfFiller offers unlimited fillable templates for PPMs and offering memorandums. 2. Gather required information: Collect all relevant information about the company, including its business plan, financial statements, and legal documents. 3. Provide clear and concise descriptions: Clearly explain the company's business model, revenue streams, and growth potential. Use language that is easy for potential investors to understand. 4. Include risk factors: Identify and disclose any potential risks or uncertainties that could affect the investment. 5. Seek legal advice: It is recommended to consult with a securities attorney to ensure compliance with all applicable laws and regulations. 6. Review and revise: Proofread the document thoroughly, checking for any errors or inconsistencies. Make revisions as needed.

pdfFiller provides the tools and resources needed to easily create, edit, and share PPMs and offering memorandums. With its unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process and empowers users to get their documents done quickly and efficiently.