Professional Insurance Agents Privacy Policy Template

Improve your document flow and simply find the Professional Insurance Agents Privacy Policy template you require in our catalog. Check with our descriptions and recommendations to find samples of the document that perfectly suit your needs. Examine templates by their purpose or by the amount of details inside. Save the templates you need in your user profile or return to our simple and organized search at any moment. All templates are predesigned for specific types of documents, so all you need to do is fill them in with your data. Streamline your paperwork with pdfFiller templates.

What is Professional Insurance Agents Privacy Policy Template?

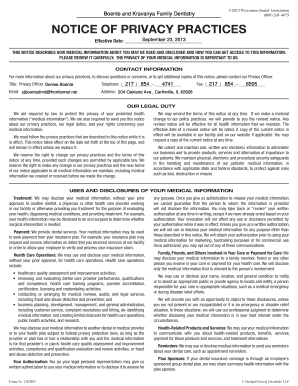

The Professional Insurance Agents Privacy Policy Template is a comprehensive document that outlines the privacy practices and policies of Professional Insurance Agents. It specifies how personal information is collected, used, and protected by the organization to ensure the confidentiality and security of user data.

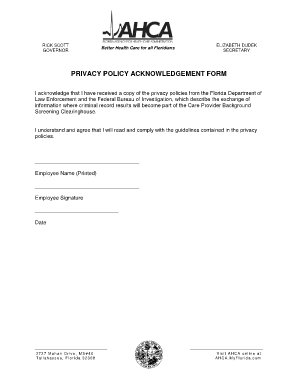

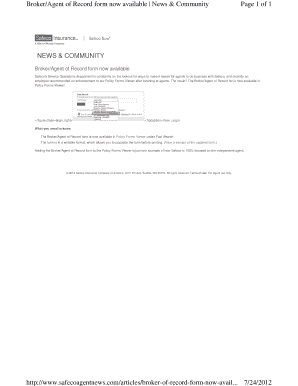

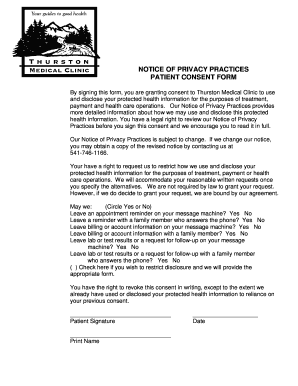

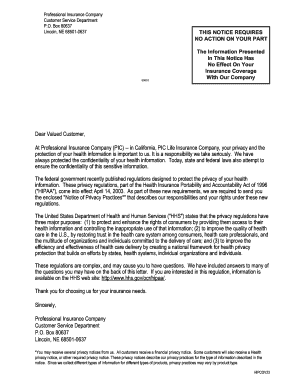

What are the types of Professional Insurance Agents Privacy Policy Template?

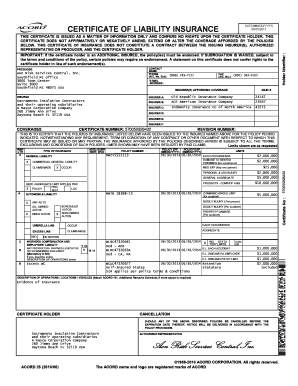

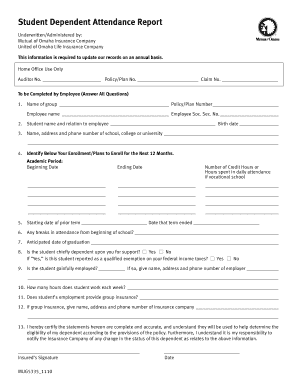

There are several types of Professional Insurance Agents Privacy Policy Templates available, including:

How to complete Professional Insurance Agents Privacy Policy Template

Completing the Professional Insurance Agents Privacy Policy Template is a straightforward process. Follow these steps to create a personalized privacy policy for your organization:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. With pdfFiller, you have everything you need to get your documents done efficiently and securely.