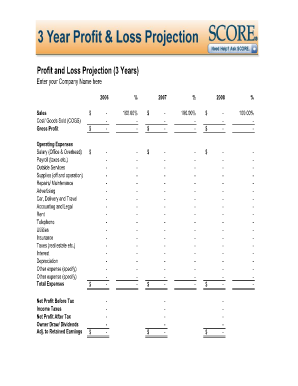

Quarterly Cash Flow Projection

What is Quarterly Cash Flow Projection?

A Quarterly Cash Flow Projection is a financial statement that forecasts the inflows and outflows of cash within a business for a specific quarter. It provides an overview of the anticipated cash movements, including revenue generation, operating expenses, investments, and financing activities. This projection enables businesses to plan and make informed decisions based on their expected cash positions.

What are the types of Quarterly Cash Flow Projection?

There are primarily two types of Quarterly Cash Flow Projections: direct and indirect. 1. Direct Cash Flow Projection: This type focuses on the actual cash flows, considering the receipts and payments made during the quarter. It provides a more detailed view of the cash position, including the cash received from customers, cash paid to suppliers, and other cash inflows and outflows. 2. Indirect Cash Flow Projection: This type starts with the net income and adjusts it for non-cash items and changes in working capital. It involves taking the net profit or loss and adding back non-cash expenses, such as depreciation and amortization, as well as considering changes in accounts receivable, accounts payable, and inventory levels.

How to complete Quarterly Cash Flow Projection

Completing a Quarterly Cash Flow Projection requires careful analysis and accurate data input. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.