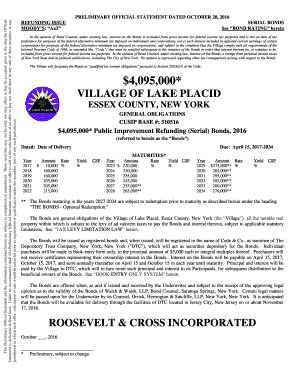

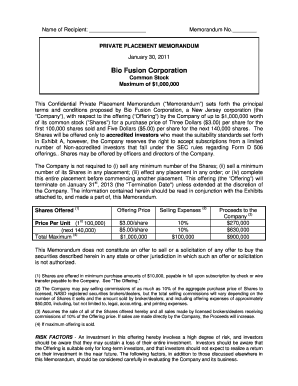

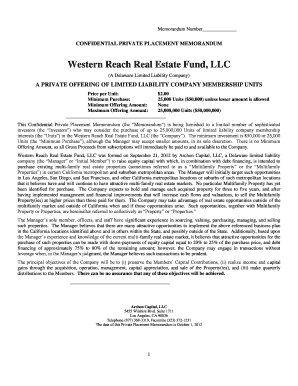

Real Estate Private Placement Memorandum

What is real estate private placement memorandum?

A real estate private placement memorandum (PPM) is a legal document that is prepared by real estate companies to present detailed information about a specific real estate investment opportunity. It provides potential investors with an in-depth understanding of the project's objectives, risks, terms, and financial projections. The PPM is an essential tool for real estate developers and sponsors to attract investors and raise funds for their projects.

What are the types of real estate private placement memorandum?

There are several types of real estate private placement memorandum, each designed to cater to specific investment opportunities: 1. Residential Real Estate PPM: These PPMs focus on residential properties such as single-family homes, condos, or apartments. 2. Commercial Real Estate PPM: These PPMs are targeted towards commercial properties such as office buildings, retail spaces, or industrial complexes. 3. Land Development PPM: These PPMs are prepared for investments in land development projects where the land is acquired for future development or sale. 4. Real Estate Investment Trust (REIT) PPM: These PPMs are used for investment opportunities in publicly traded REITs that own and manage income-generating real estate properties.

How to complete real estate private placement memorandum

Completing a real estate private placement memorandum requires attention to detail and thorough analysis. Here are the steps to guide you through the process: 1. Gather all relevant information: Collect all the necessary details about the investment opportunity, including financial projections, property information, market analysis, and legal documentation. 2. Craft the executive summary: Summarize the key points of the investment opportunity, highlighting the potential benefits and risks. 3. Provide project details: Include a thorough description of the real estate project, its location, features, and any unique selling points. 4. Clearly outline terms and conditions: Specify the investment structure, preferred returns, profit-sharing arrangements, and exit strategies. 5. Present financial projections: Include detailed financial forecasts, such as projected revenues, expenses, and return on investment. 6. Include risk factors: Disclose potential risks and mitigating factors associated with the investment. 7. Seek legal and professional assistance: To ensure compliance and accuracy, consider consulting with legal and financial professionals while completing the PPM.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.