Sample Articles Of Incorporation Nonprofit

What is sample articles of incorporation nonprofit?

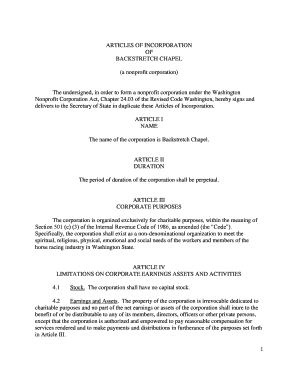

The sample articles of incorporation nonprofit refers to a legal document that establishes a nonprofit organization. It outlines the purpose, structure, and operations of the nonprofit entity. These articles are essential for obtaining tax-exempt status and defining the nonprofit's mission, governance, and activities.

What are the types of sample articles of incorporation nonprofit?

There are several types of sample articles of incorporation nonprofit, including:

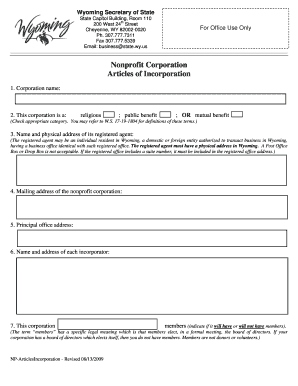

Public Benefit Corporations: These nonprofits are formed to provide a public benefit, such as promoting education, health, or other charitable purposes.

Religious Corporations: These nonprofits are formed for religious purposes and often serve as places of worship or religious organizations.

Mutual Benefit Corporations: These nonprofits are formed to serve the mutual interests of their members, which can include social clubs or trade associations.

Private Foundations: These nonprofits are established with funds from a single source and are primarily focused on providing grants to other organizations.

Charitable Trusts: These nonprofits are created to hold and manage assets for charitable purposes, with trustees overseeing the distribution of funds.

How to complete sample articles of incorporation nonprofit

Completing the sample articles of incorporation nonprofit involves the following steps:

01

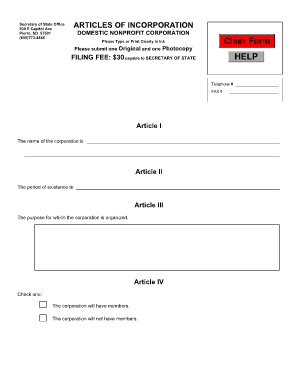

Identify the Purpose: Clearly define the purpose and mission of the nonprofit organization, including the activities it will undertake.

02

Choose a Name: Select a unique name for the nonprofit that reflects its mission and is in compliance with legal requirements.

03

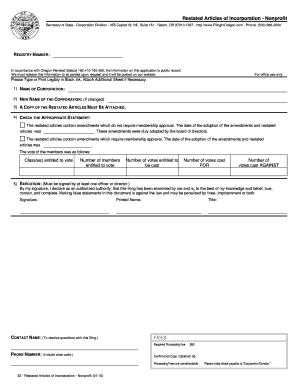

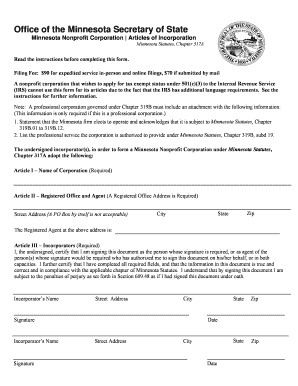

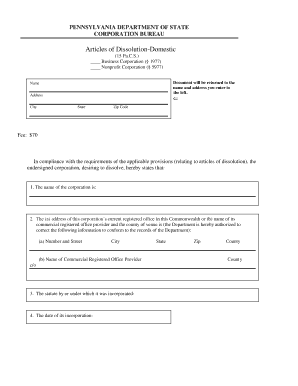

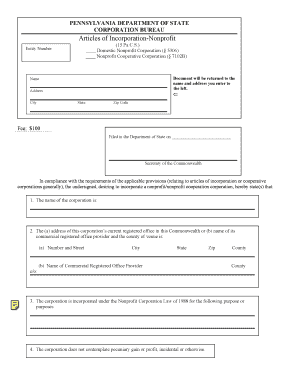

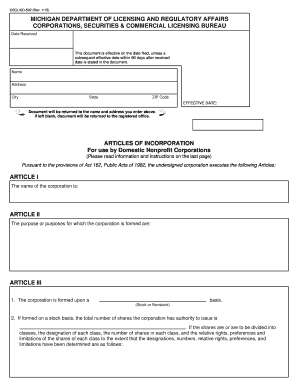

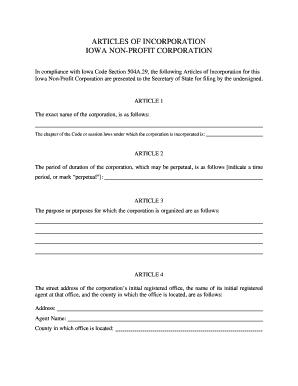

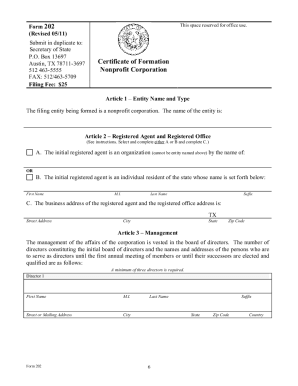

Draft the Articles: Prepare the articles of incorporation, including necessary details like the organization's name, purpose, principal office, board members, and dissolution clause.

04

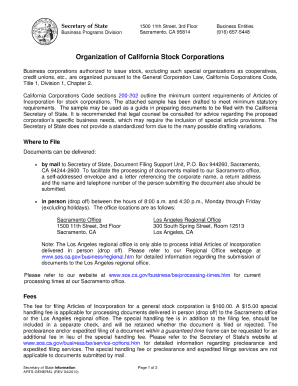

File with the State: Submit the completed articles of incorporation along with any required fees to the state's filing office.

05

Obtain Tax-Exempt Status: Apply for tax-exempt status with the Internal Revenue Service (IRS) to qualify for federal tax benefits.

06

Develop Bylaws: Create bylaws that outline the internal rules and procedures for the nonprofit's governance and operations.

07

Establish a Board of Directors: Formulate a board of directors comprising individuals who will oversee and guide the nonprofit's activities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be the content of the articles of incorporation?

Typically, the articles must contain, at the very least: the corporation's name and business address. the number of authorized shares and the par value (if any) of the shares. the name and address of the in-state registered agent.

How do you write an article of incorporation for a non profit?

What should your 501c3 Nonprofit Articles of Incorporation include? Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization (Every State asks for this)

What is the difference between articles of incorporation and bylaws?

Bylaws are not the same as articles of incorporation—the articles are a short document filed with your state to form your business. Bylaws are a longer, more detailed, internal document. Both for-profit and nonprofit corporations should have bylaws.

Why should a non profit be incorporated?

SPECIFIC SITUATIONS TO INCORPORATE A NONPROFIT: When you want to ensure that you have tax-exempt status. When you will solicit tax-deductible donations or contributions. When you want to limit personal liability from the organization's activities. When any potential political activities could lead to lawsuits.

What is an article of incorporation for a non profit?

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

How do you write articles of incorporation?

How do I create Articles of Incorporation? Step 1: State where the corporation is incorporating. Step 2: Provide details about the person filing the Articles of Incorporation. Step 3: State the corporation's name, purpose and duration. Step 4: Include details about the registered agent and office.

Related templates