What is Sample Credit Application?

A sample credit application is a document used by individuals or businesses to apply for credit from a lender. It contains information about the applicant, such as their personal details, financial history, employment information, and the amount of credit they are requesting. This document is essential for lenders to assess the applicant's creditworthiness and make an informed decision about granting credit.

What are the types of Sample Credit Application?

Sample credit applications can vary depending on the specific needs of the lender and the type of credit being applied for. Some common types of credit applications include:

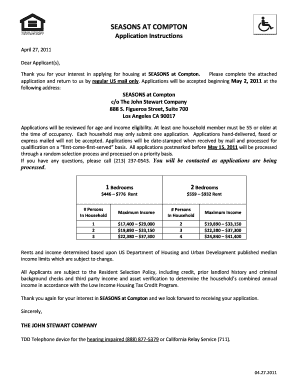

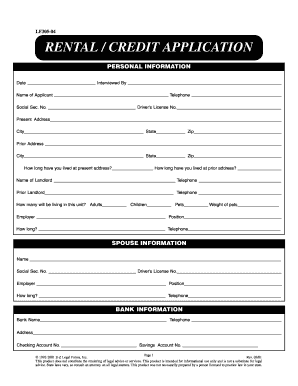

Personal Credit Application - Used by individuals applying for personal loans or credit cards.

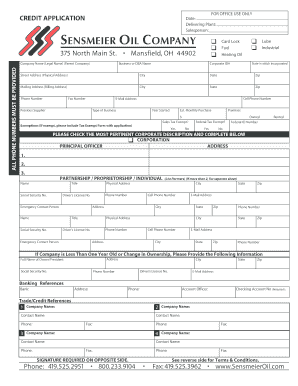

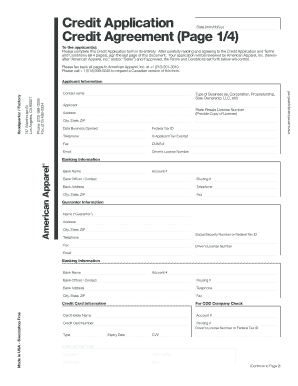

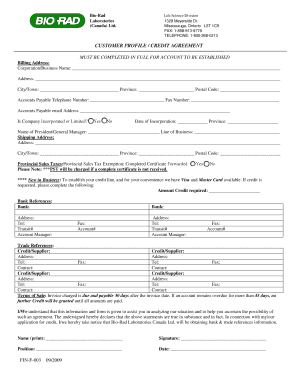

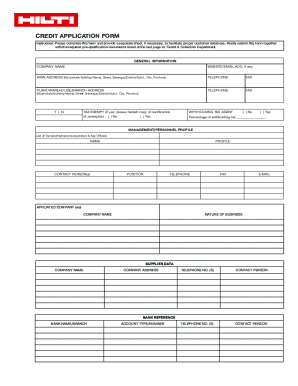

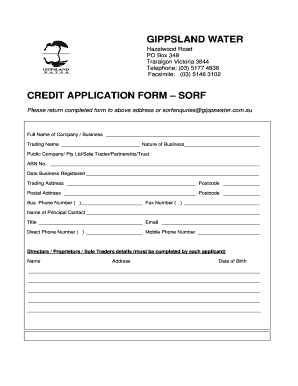

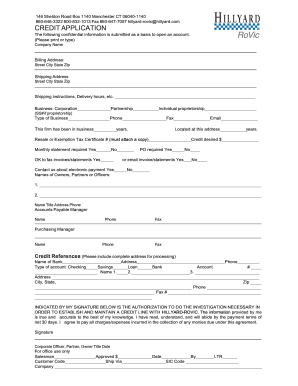

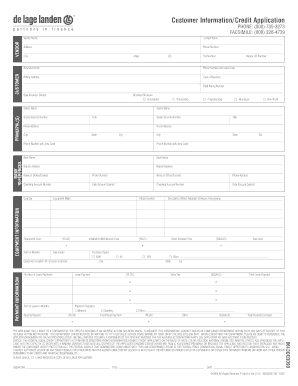

Business Credit Application - Used by businesses seeking credit or financing for their operations.

Mortgage Credit Application - Used by individuals applying for a mortgage loan to purchase a property.

Auto Loan Credit Application - Used by individuals applying for a loan to purchase a vehicle.

How to complete Sample Credit Application

Completing a sample credit application is a relatively straightforward process. Here are the steps to follow:

01

Start by downloading a sample credit application form from a reputable source or acquire one from your lender.

02

Read through the form carefully to understand the information requested.

03

Gather all the necessary documents and information, such as your personal identification details, financial records, and employment history.

04

Fill in the required fields accurately and truthfully. Double-check the information before submitting.

05

Attach any supporting documents requested by the application form.

06

Submit the completed application form to the lender through the designated method, such as in person, by mail, or electronically.

07

Keep a copy of the completed application and any supporting documents for your records.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.