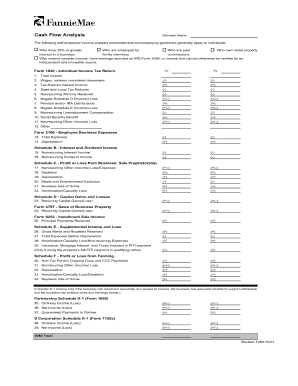

Simple Personal Cash Flow Statement

What is Simple Personal Cash Flow Statement?

A Simple Personal Cash Flow Statement is a financial tool that helps individuals track their income and expenses over a specific period of time. It provides a clear picture of the cash inflows and outflows, allowing users to analyze their financial situation and make informed decisions.

What are the types of Simple Personal Cash Flow Statement?

There are two main types of Simple Personal Cash Flow Statements:

Direct Method: This method involves recording actual cash inflows and outflows directly. It provides a more accurate representation of an individual's cash flow.

Indirect Method: This method starts with net income and makes adjustments to calculate the cash flow from operations. It is based on the accrual accounting system and may not reflect the actual cash flow situation.

How to complete Simple Personal Cash Flow Statement

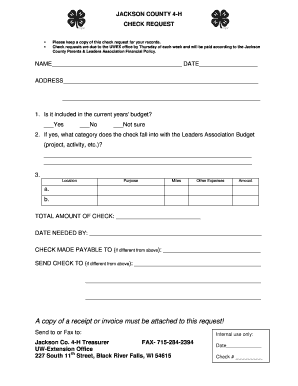

Completing a Simple Personal Cash Flow Statement is relatively straightforward. Here are the steps:

01

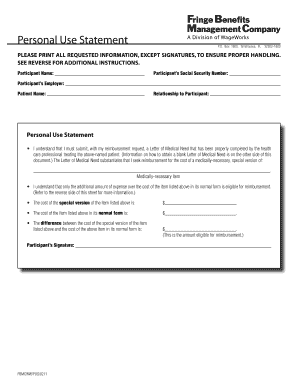

Gather all necessary financial documents, including bank statements, income statements, and expense receipts.

02

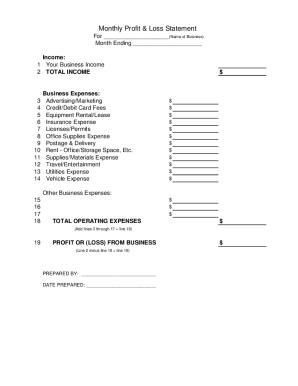

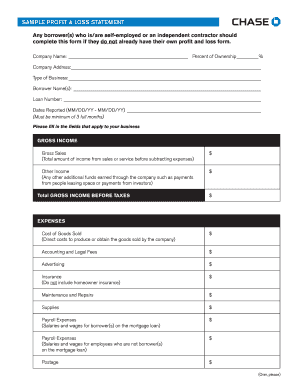

Categorize your income and expenses into different groups, such as salary, rent, utilities, groceries, etc.

03

Calculate your total income by summing up all the sources of income.

04

Calculate your total expenses by summing up all the categories of expenses.

05

Subtract your total expenses from your total income to determine your net cash flow.

06

Analyze your cash flow statement to identify areas where you can reduce expenses or increase income.

07

Update your cash flow statement regularly to track changes in your financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple Personal Cash Flow Statement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

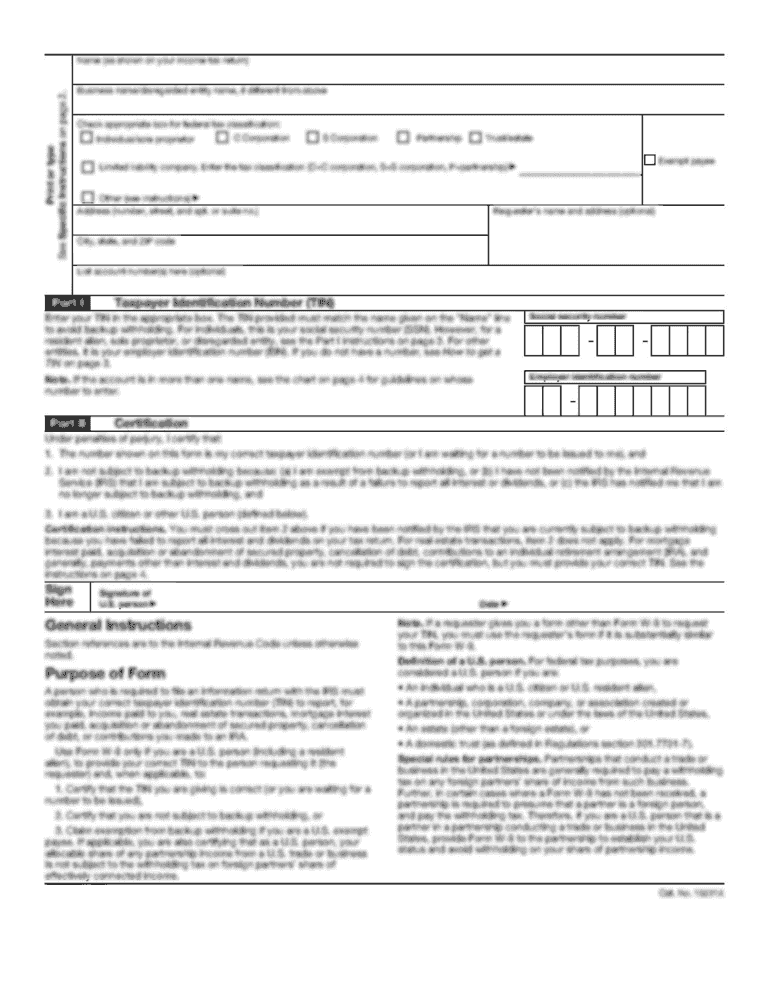

What is included in a personal cash flow statement?

The personal cash flow statement measures your cash inflows (money you earn) and your cash outflows (money you spend) to determine if you have a positive or negative net cash flow. A personal balance sheet summarizes your assets and liabilities in order to calculate your net worth.

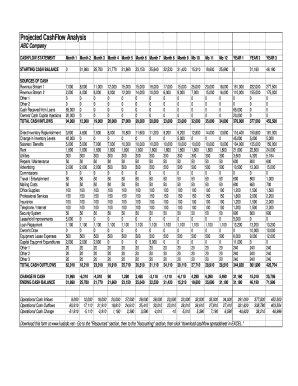

Does Excel have a cash book template?

There are 10 ready-to-use types of excel cash book template free available in Excel, Google Sheets, and Open Office Calc formats. You can enter the transaction on the debit or credit side, and the cash on hand will be automatically calculated.

How do you prepare a cash flow statement for individuals?

How to Create a Cash Flow Statement Determine the Starting Balance. Calculate Cash Flow from Operating Activities. Calculate Cash Flow from Investing Activities. Calculate Cash Flow from Financing Activity. Determine the Ending Balance.

How do you create a direct cash flow statement in Excel?

Steps to Prepare the Cash Flow Statement Adjust Net Income for Non-Cash Items. Adjust Net Income For Changes in Non-Cash Working Capital. Add or Subtract Cash From Investing Activities. Add or Subtract Cash From Financing Activities.

What does a personal cash flow statement represent?

They show your liquidity. That means you know exactly how much operating cash flow you have in case you need to use it. So you know what you can afford, and what you can't. They show you changes in assets, liabilities, and equity in the forms of cash outflows, cash inflows, and cash being held.

How do you make a cash flow sheet on Excel?

Cash Flow Statement formulas are pretty simple. All you need is to use the sum command to subtotal each category. First, select the Net Cash Flow - [Category] cell under the corresponding period and category subtotal. Then, type =sum( and choose all the cells for each section.