What is startup budget example?

A startup budget example is a financial plan that outlines the expected income and expenses of a new business venture over a specific period of time. It helps entrepreneurs estimate how much money they will need to start and run their business, as well as determine the profitability and sustainability of their venture.

What are the types of startup budget example?

There are several types of startup budget examples that entrepreneurs can use depending on their business model and industry. Some common types include:

Sales and Marketing Budget: This budget focuses on the costs associated with promoting the business and acquiring customers.

Operational Budget: This budget covers the day-to-day expenses of running the business, such as rent, utilities, and supplies.

Personnel Budget: This budget includes the costs of hiring and paying employees, including salaries, benefits, and taxes.

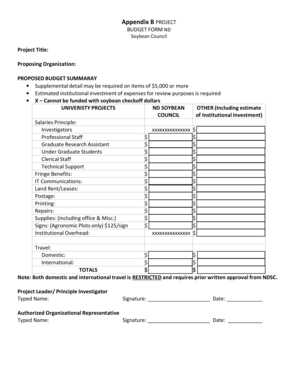

Capital Budget: This budget outlines the investments required for long-term assets, such as equipment, machinery, and property.

Research and Development Budget: This budget is for businesses that heavily rely on innovation and need funds for research and product development.

Contingency Budget: This budget sets aside funds for unexpected expenses or emergencies.

How to complete startup budget example

Completing a startup budget example requires careful planning and analysis. Here are some steps to follow:

01

Identify Income Sources: Determine where the startup will generate revenue, such as product sales, subscriptions, or service fees.

02

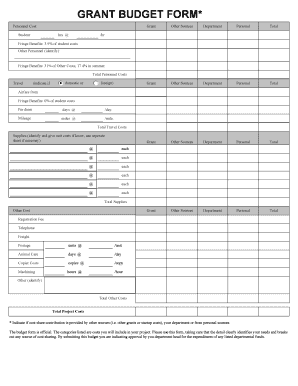

Estimate Expenses: List all the costs associated with starting and operating the business, including fixed expenses (rent, utilities) and variable expenses (inventory, marketing).

03

Calculate Cash Flow: Determine the inflow and outflow of cash over a specific period to assess the financial health of the business.

04

Allocate Budget: Allocate funds to different categories based on their importance and estimated impact on the business growth.

05

Monitor and Adjust: Regularly review the actual income and expenses against the projected budget and make adjustments as necessary.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.