Taxi Receipt

What is Taxi Receipt?

A taxi receipt is a document given by a taxi driver to a passenger after the fare has been paid. It serves as proof of payment for the service provided.

What are the types of Taxi Receipt?

There are several types of taxi receipts, including:

Handwritten taxi receipts

Printed taxi receipts

Electronic taxi receipts

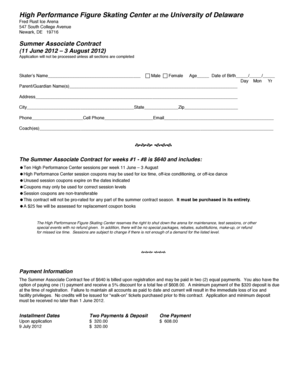

How to complete Taxi Receipt

Completing a taxi receipt is a straightforward process that involves the following steps:

01

Fill in the date and time of the trip

02

Write down the starting and ending locations

03

Enter the fare amount

04

Add any additional charges, such as tolls or waiting time

05

Include any tips given to the driver

06

Sign the receipt to acknowledge payment

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

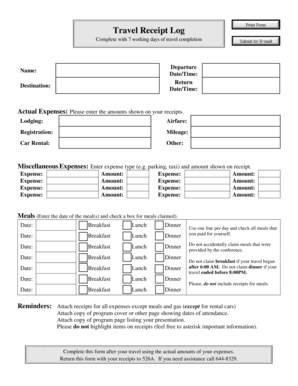

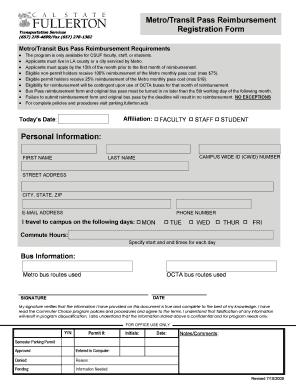

How do you write a transportation receipt?

Inclusions of a Transport Receipt The date that the payment has been made. The initial location of the entity or any other material for transport. The destination of the transport services. The name of the person who paid for the transaction.

How can I make my own receipt?

How can I make my own receipt? The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment. A return policy.

How do you create a receipt in Word?

0:00 0:25 How to Create a Receipt in Microsoft Word - YouTube YouTube Start of suggested clip End of suggested clip Select new over to the right of office comm click in the space and type in receipt. Press Enter lookMoreSelect new over to the right of office comm click in the space and type in receipt. Press Enter look at the receipt.

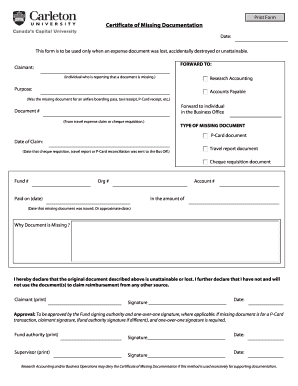

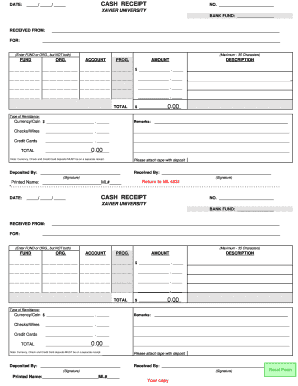

How do I create a receipt for a document?

What information must I put on a receipt? your company's details including name, address, phone number and/or email address. the date of transaction showing date, month and year. a list of products or services showing a brief description of the product and quantity sold.

How do I get a NYC taxi receipt?

You can get help contacting the taxi driver to request a duplicate receipt for your yellow or green taxi ride. Your request must include: Medallion/license number or driver's license number. Date and time of the ride.

How can I make a homemade receipt?

How can I make my own receipt? The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment. A return policy.

Related templates