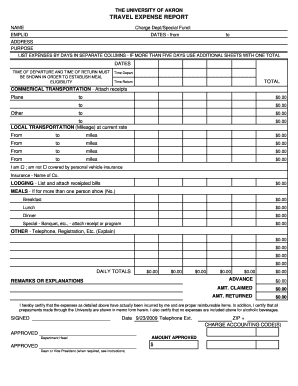

Travel Expense Report Form

What is Travel Expense Report Form?

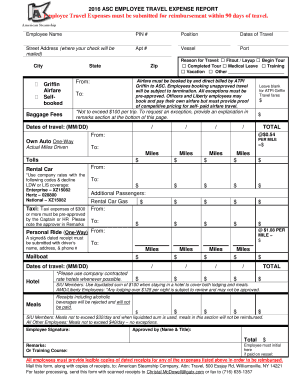

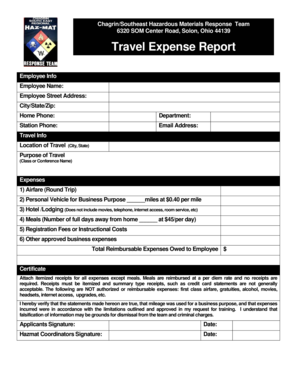

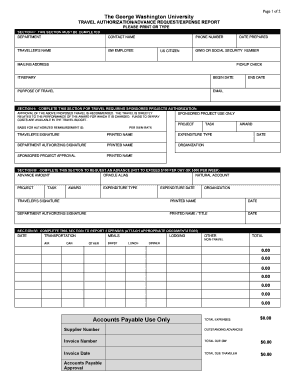

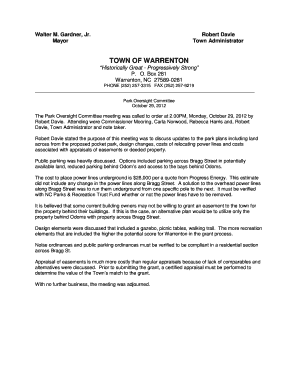

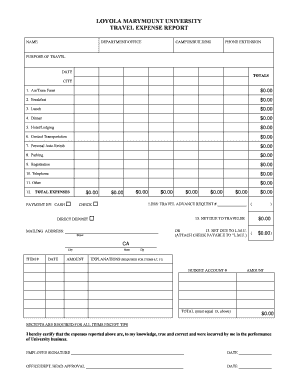

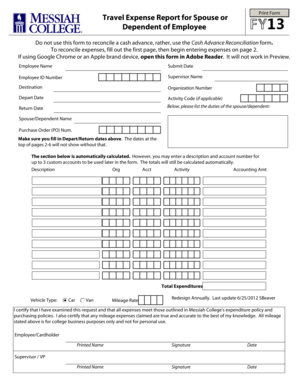

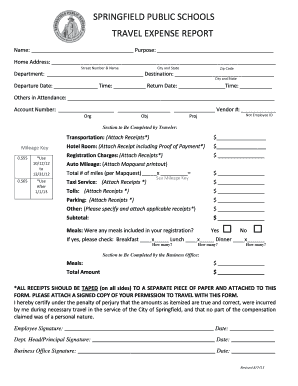

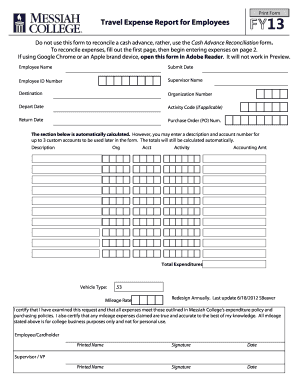

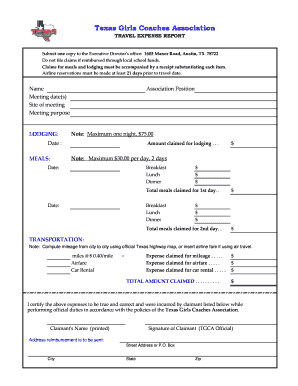

A Travel Expense Report Form is a document used to track and record expenses incurred during business travels. It allows individuals to detail their travel-related expenses, such as accommodation, transportation, meals, and other miscellaneous costs.

What are the types of Travel Expense Report Form?

There are various types of Travel Expense Report Forms tailored to specific needs and organizational requirements. Some common types include:

Mileage Reimbursement Form: Used to report mileage expenses for using a personal vehicle for business travel.

Per Diem Expense Form: Used to claim daily allowances for meals, lodging, and incidental expenses during travel.

International Expense Report Form: Used when traveling internationally, it includes additional sections for currency exchange rates and other related expenses.

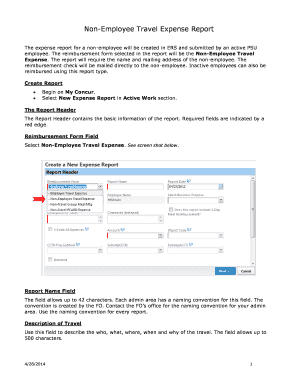

How to complete Travel Expense Report Form

Completing a Travel Expense Report Form is a simple process that involves the following steps:

01

Provide personal information such as name, employee ID, and contact details.

02

Specify the travel dates and destination.

03

Itemize and categorize each expense incurred during travel, including receipts when available.

04

Calculate the total expenses for each category and provide a grand total.

05

Submit the completed form to the designated authority for approval and reimbursement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and professionally.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you prepare travel expense reports?

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

What is a travel expense report?

Travel and expense reports are physical or digital documents that include all of the relevant details for a travel-related expense, including the amount of the purchase, the date, and expense category.

How do you keep track of expenses while traveling?

7 Apps that Will Help You Track Travel Expenses TrabeePocket. TrabeePocket is available on iOS as well as for Android users. Trail Wallet. This app, available on iOS, allows you to track your travel expenses by tracking how much money you spend each day during your trip. Concur. Spent. Tripcoin. Splitwise. Foreceipt.

How do I write a travel expense letter?

Here I would like to request reimbursement of my travel expenses for an amount of 5800 Rs which I spent for attending the interview and please find all the bills attached with this email. I shall be thankful to you in this matter. Thanking you.

What are examples of travel expenses?

Examples of travel expenses include airfare and lodging, transport services, cost of meals and tips, use of communications devices. Travel expenses incurred while on an indefinite work assignment, which lasts more than one year according to the IRS, are not deductible for tax purposes.

How do you write a travel expense report?

Of course, there are further details to be included in the travel expense report: Full name. Department. Personnel number. Start and end of trip with exact time of day. Destination of the trip. Travel purpose. Means of transport used. Signatures of claimant (employee) and supervisor.

Related templates