What is a vehicle lease agreement between an individual and a company?

A vehicle lease agreement between an individual and a company is a legal contract that outlines the terms and conditions of leasing a vehicle. It is an agreement that allows the individual to use the company's vehicle for a specified period of time in exchange for regular lease payments. The agreement also includes details such as the type of vehicle, lease duration, mileage limitations, insurance requirements, and any additional fees or penalties.

What are the types of vehicle lease agreement between an individual and a company?

There are several types of vehicle lease agreements between an individual and a company. They include:

Open-end leases: In this type of lease, the individual is responsible for the residual value of the vehicle at the end of the lease term. This means that if the vehicle depreciates more than expected, the individual may have to pay the difference.

Closed-end leases: This type of lease is more common and offers the individual a fixed monthly payment for the lease term. At the end of the lease, the individual can return the vehicle without any additional financial obligations.

Sublease agreements: In some cases, the individual may sublease the vehicle to another party, allowing them to use the vehicle and make lease payments on their behalf.

How to complete a vehicle lease agreement between an individual and a company

Completing a vehicle lease agreement between an individual and a company requires attention to detail and adherence to the following steps:

01

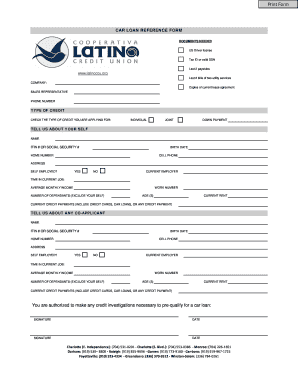

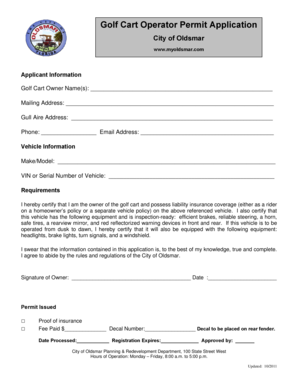

Gather necessary information: Collect all relevant information about the vehicle, including its make, model, year, and identification number. Also, gather personal and contact details of both parties involved.

02

Define lease terms: Determine the lease duration, monthly payment amount, mileage restrictions, and any additional provisions or conditions to be included in the agreement.

03

Review and negotiate: Carefully review the lease agreement and negotiate any terms that need clarification or modification. Ensure both parties agree to the final terms before proceeding.

04

Sign the agreement: Once all terms are agreed upon, both parties should sign the lease agreement. It is essential to keep a copy for each party's records.

05

Maintain communication: Throughout the lease period, maintain open communication between the individual and the company to address any concerns or issues that may arise.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.