What is vehicle mileage log book?

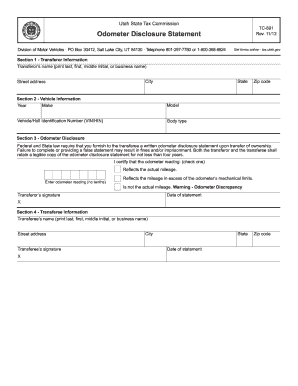

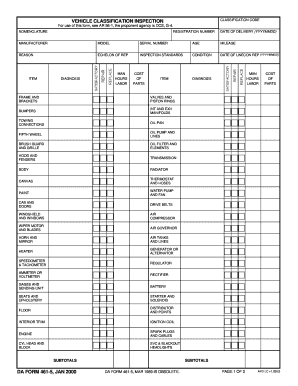

A vehicle mileage log book is a written record that individuals or businesses use to track and record the distance traveled by a vehicle. It helps to keep a record of the mileage for various purposes, such as calculating business expenses, reimbursements, or tax deductions. In the log book, you note down the starting and ending odometer readings, dates, destinations, and the purpose of each trip.

What are the types of vehicle mileage log book?

There are various types of vehicle mileage log books available, depending on individual preferences and needs. Some common types include:

Paper log books: These are traditional printed log books where you manually write down the mileage details.

Electronic log books: These are digital log books that can be stored on mobile devices or computer software. They often come with features like automatic mileage tracking and GPS integration.

Mobile apps: Many mobile applications are specifically designed to record and manage mileage logs. They offer convenience and automation in tracking mileage.

Online templates: Online platforms provide customizable mileage log templates that can be accessed and filled out digitally.

How to complete vehicle mileage log book

Completing a vehicle mileage log book is a straightforward process. Here are the steps to follow:

01

Start by entering the date and time of each trip.

02

Record the starting and ending odometer readings for each trip.

03

Note down the purpose of the trip, such as business-related, personal, or specific client visits.

04

Enter the destination or locations traveled during each trip.

05

Include any additional important details, such as toll expenses or parking fees.

06

Review and double-check the accuracy of the recorded information.

07

Summarize the total mileage and any related expenses.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.