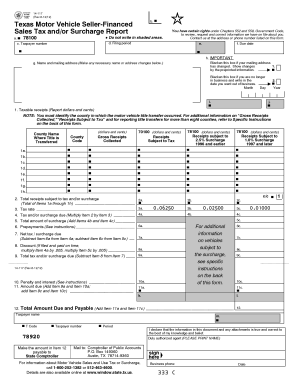

Vehicle Sales Contract With Seller Financing

What is vehicle sales contract with seller financing?

A vehicle sales contract with seller financing is a legal agreement between the seller of a vehicle and the buyer, where the seller provides financing for the purchase of the vehicle. In this type of contract, the buyer makes installment payments to the seller over an agreed period of time, typically with interest added. This arrangement allows buyers who may not qualify for traditional bank loans to still be able to purchase a vehicle.

What are the types of vehicle sales contract with seller financing?

There are two main types of vehicle sales contracts with seller financing: 1. Installment Sales Contract: This type of contract involves the buyer making regular installment payments to the seller over a specified period of time until the full purchase price of the vehicle is paid off. 2. Lease Purchase Agreement: This type of contract allows the buyer to lease the vehicle with an option to purchase it at the end of the lease term. The buyer makes monthly lease payments to the seller and can exercise the option to buy the vehicle at a predetermined price.

How to complete vehicle sales contract with seller financing

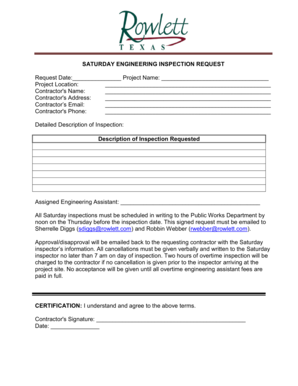

Completing a vehicle sales contract with seller financing is a fairly straightforward process. Here are the steps to follow: 1. Gather the necessary information: Both the buyer and seller should have their personal information ready, including names, addresses, and contact information. 2. Specify the terms: Clearly outline the terms of the agreement, including the purchase price, interest rate (if applicable), repayment schedule, and any other relevant details. 3. Include the vehicle details: Provide a detailed description of the vehicle being sold, including make, model, year, VIN number, and any other important identification details. 4. Obtain signatures: Both the buyer and seller should sign and date the contract to make it legally binding. 5. Keep copies: Make copies of the completed contract for both parties to keep for their records.

pdfFiller empowers users to create, edit, and share documents online, including vehicle sales contracts with seller financing. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done smoothly and efficiently.