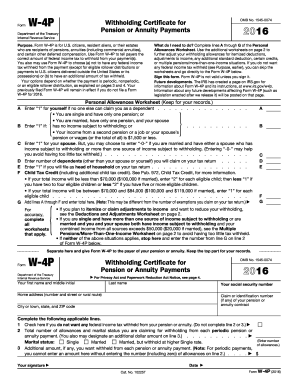

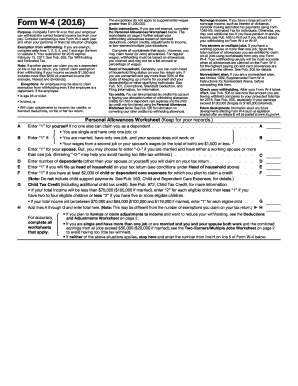

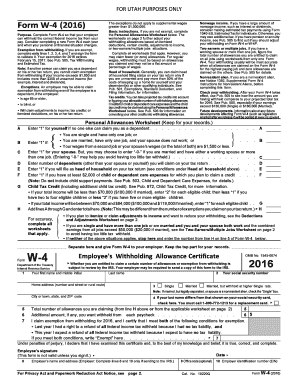

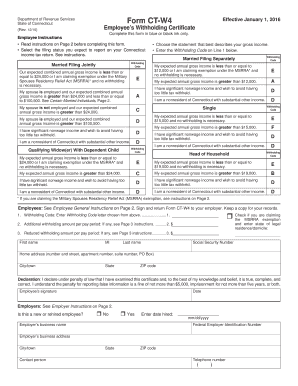

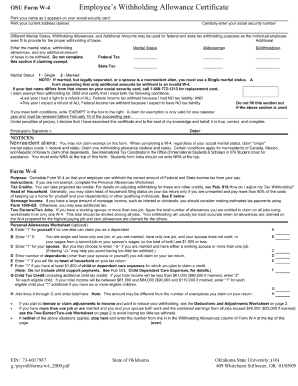

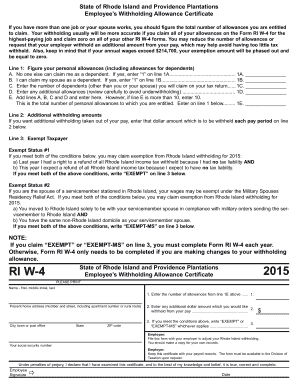

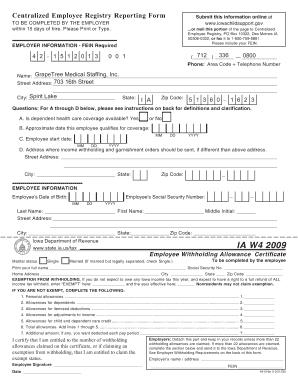

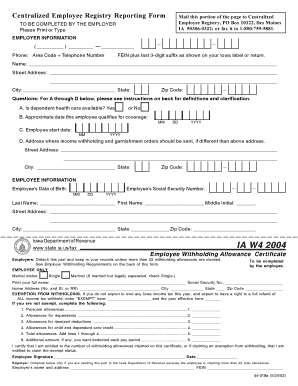

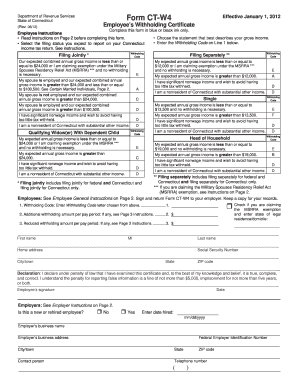

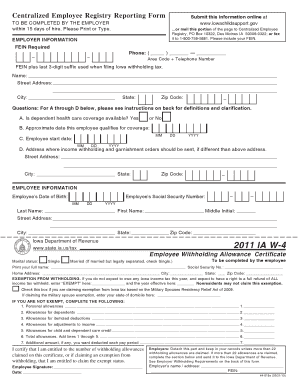

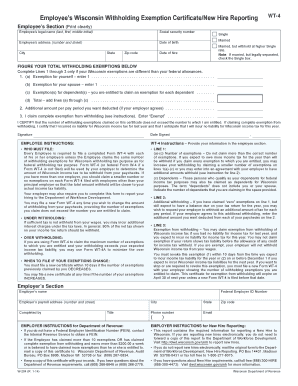

W-4 2016

What is w-4 2016?

W-4 2016 is a tax form used by employees to indicate their withholding preferences for federal income taxes. By completing this form, employees provide information on their filing status, allowances, and any additional withholding amounts for deductions or credits. This form helps employers accurately calculate the amount of federal income tax to withhold from an employee's paycheck.

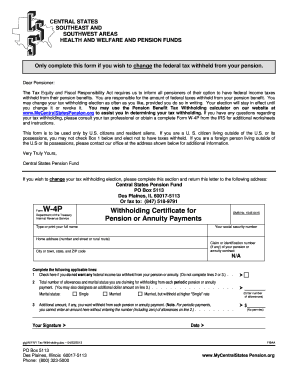

What are the types of w-4 2016?

There are two types of W-4 forms for the year 2016: the regular W-4 form and the W-4P form. The regular W-4 form is used by employees who are not eligible for the pension or annuity income. On the other hand, the W-4P form is used by retirees or individuals receiving a pension or annuity income. It allows them to specify the withholding amounts for federal income tax.

How to complete w-4 2016

To complete the W-4 2016 form, follow these steps:

Remember to review your completed form for accuracy before submitting it to your employer. If you have any questions or need assistance, consider using pdfFiller, an online tool that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.