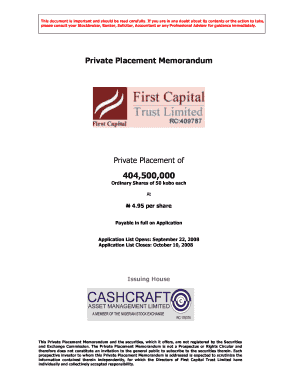

What is a private placement memorandum?

A private placement memorandum, also known as a PPM, is a legal document that provides information about a company or investment opportunity to potential investors. It typically includes details about the company's business model, financial projections, risks, and terms of the investment. The purpose of a private placement memorandum is to provide investors with the information they need to make an informed decision about whether to invest in the opportunity.

What are the types of private placement memorandum?

Private placement memorandums can vary in format and structure depending on the specific investment opportunity. However, some common types of private placement memorandums include:

Equity PPM: This type of PPM is used when a company is seeking to raise capital by selling shares of its stock.

Debt PPM: A debt PPM is used when a company wants to borrow money from investors and agrees to pay it back with interest.

Real Estate PPM: This type of PPM is specific to real estate investments and provides information about the property, financing, and potential returns.

Startup PPM: A startup PPM is tailored to early-stage companies seeking funding and typically includes details about the product or service, market potential, and growth strategy.

How to complete a private placement memorandum?

Completing a private placement memorandum requires careful attention to detail and adherence to legal and regulatory requirements. Here are some steps to help you complete a private placement memorandum:

01

Gather all necessary information: Collect all relevant information about the company or investment opportunity, including financial statements, market research, and legal documentation.

02

Draft the document: Use a template or consult with legal professionals to create a comprehensive private placement memorandum that includes all required sections and disclosures.

03

Review and revise: Carefully review the document to ensure accuracy, consistency, and compliance with applicable laws and regulations. Make any necessary revisions or additions.

04

Obtain legal review: Have the private placement memorandum reviewed by a legal professional to ensure it meets all legal requirements and adequately discloses risks and terms.

05

Distribute to potential investors: Share the private placement memorandum with potential investors, either physically or electronically, to provide them with the necessary information to make an informed investment decision.

pdfFiller is a powerful online platform that empowers users to easily create, edit, and share documents, including private placement memorandums. With unlimited fillable templates and robust editing tools, pdfFiller is the ideal solution for individuals and businesses looking to streamline their document creation process. Whether you need to complete a private placement memorandum or any other document, pdfFiller has you covered.