What Should Be Included In A Risk Management Plan

What is what should be included in a risk management plan?

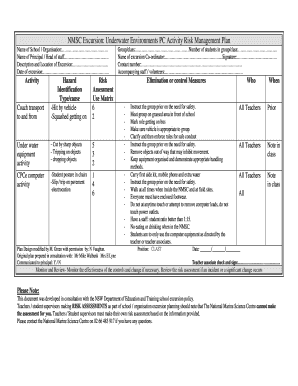

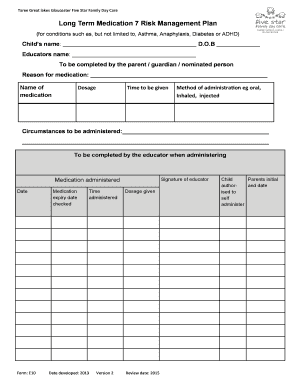

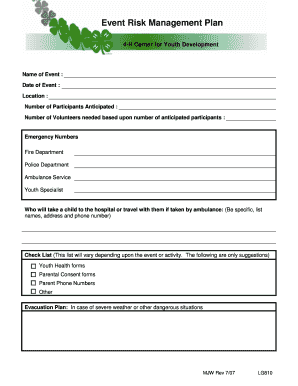

A risk management plan is a comprehensive document that outlines the potential risks and strategies to mitigate them in a project or business. It should include a thorough analysis of possible risks, their potential impacts, and a clear plan of action to manage or avoid them. The plan should also outline the responsibilities of individuals or teams involved in risk management, as well as the tools or resources that will be utilized to effectively monitor and address risks.

What are the types of what should be included in a risk management plan?

In a risk management plan, various types of risks should be considered and covered. Some common types of risks that should be included in a risk management plan are:

How to complete what should be included in a risk management plan

Completing a risk management plan involves several key steps. Here is a step-by-step guide on how to complete what should be included in a risk management plan:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.