What is a Will And Trust Form?

A Will and Trust Form is a legal document that allows individuals to outline their wishes for the distribution of their assets and the management of their affairs after they pass away. This form serves as a way to ensure that your property and possessions are distributed according to your wishes.

What are the types of Will And Trust Form?

There are different types of Will and Trust Forms available depending on the specific needs and circumstances of the individual. Some common types include:

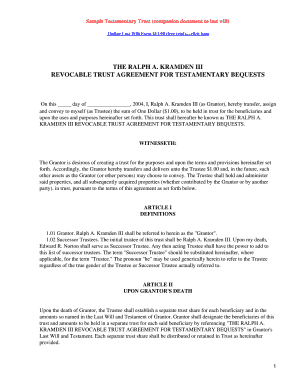

Last Will and Testament: This is a basic form that allows you to specify how your assets should be distributed and who should be the executor of your estate.

Living Will: This form outlines your preferences for medical treatment in the event that you become unable to communicate your wishes.

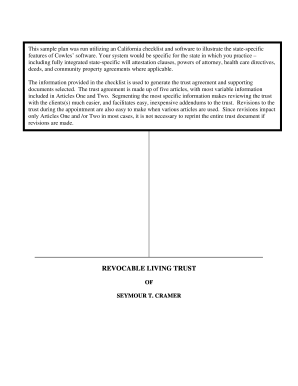

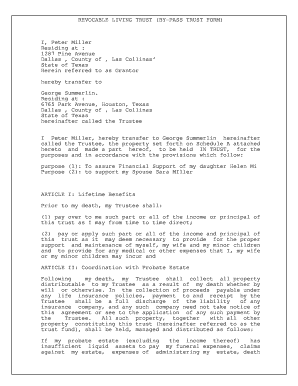

Revocable Living Trust: This trust form allows you to transfer your assets to a trust during your lifetime, which can help avoid probate and provide for the management of your assets in the event of incapacity.

Irrevocable Living Trust: This type of trust cannot be modified or revoked once it is established and provides additional asset protection benefits.

Special Needs Trust: This trust is designed to provide for the financial needs of individuals with disabilities without affecting their eligibility for government assistance programs.

How to complete Will And Trust Form

Completing a Will and Trust Form may seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to complete a Will and Trust Form:

01

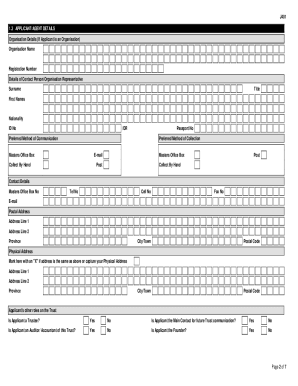

Gather necessary information and documents such as your personal details, asset information, and designated beneficiaries or trustees.

02

Choose the appropriate Will and Trust Form that best suits your needs.

03

Carefully read and understand the instructions provided with the form.

04

Fill in the required fields accurately and ensure all information provided is up to date.

05

Review the completed form for any errors or omissions.

06

Print and sign the form in the presence of witnesses or a notary public as required by law.

07

Distribute copies of the completed form to relevant parties such as your executor or trustee.

With pdfFiller, you can easily complete your Will and Trust Form online. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.