Free Debt Agreement Word Templates

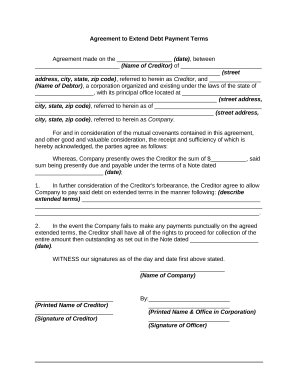

What are Debt Agreement Templates?

Debt Agreement Templates are pre-designed forms that individuals or businesses can use to outline the terms and conditions of a debt agreement between parties. These templates help in documenting the agreement in a clear and concise manner, ensuring that all parties involved understand their obligations and responsibilities.

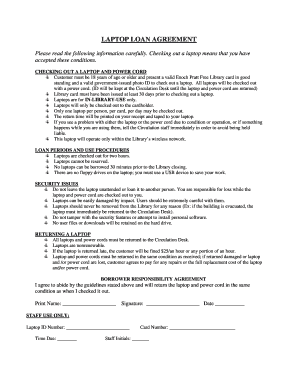

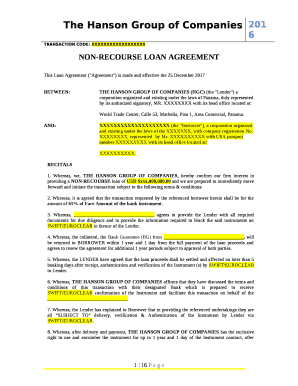

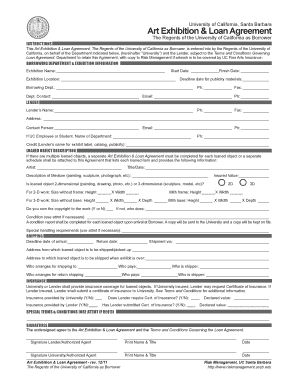

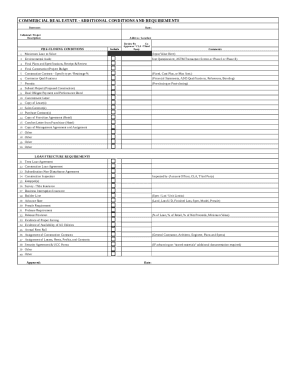

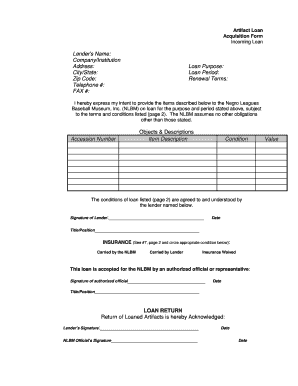

What are the types of Debt Agreement Templates?

There are several types of Debt Agreement Templates available, including: 1. Personal Debt Agreement Templates 2. Business Debt Agreement Templates 3. Loan Debt Agreement Templates 4. Settlement Debt Agreement Templates 5. Payment Plan Debt Agreement Templates

How to complete Debt Agreement Templates

Completing Debt Agreement Templates is a straightforward process that can be done by following these simple steps: 1. Fill in the necessary information, such as names, addresses, and contact details of the parties involved. 2. Specify the amount of debt, repayment terms, and any other relevant terms and conditions. 3. Review the completed agreement to ensure accuracy and completeness. 4. Sign and date the agreement to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.