Free Startup Budget Word Templates - Page 3

What are Startup Budget Templates?

Startup Budget Templates are pre-designed spreadsheets or digital forms that help individuals and businesses plan and track their financial resources. These templates provide a structured format for organizing income, expenses, and other financial data to ensure a clear overview of the financial health of a startup.

What are the types of Startup Budget Templates?

There are several types of Startup Budget Templates available to cater to different business needs. Some common types include:

Basic Startup Budget Template

Detailed Startup Budget Template

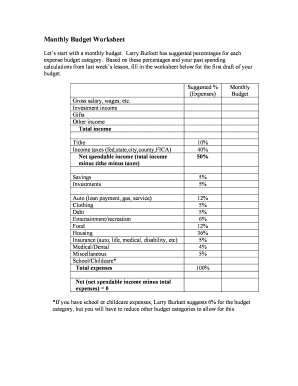

Monthly/Yearly Startup Budget Template

Project-Based Startup Budget Template

How to complete Startup Budget Templates

Completing Startup Budget Templates is essential for effective financial planning. Follow these steps to ensure accurate budgeting:

01

Gather all financial information, including income sources, fixed expenses, variable expenses, etc.

02

Input the data into the relevant sections of the template, ensuring accuracy and completeness.

03

Review the completed budget template to identify any discrepancies or areas for improvement.

04

Make necessary adjustments to ensure the budget aligns with financial goals and objectives.

05

Save and regularly update the budget template to track financial progress and make informed decisions.

06

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Startup Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the purpose of start up costs?

Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses.

What are 3 startup costs?

Small Business Startup Expense FAQs Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

Why do you need a start up budget?

An operational budget helps startups identify how much money they need to cover their day-to-day expenses, such as payroll, rent, and other costs related to running the business. An operational budget allows a company to plan for and manage its resources in the most efficient way possible.

Why is a startup budget important?

A budget helps startups keep track of costs and limits overspending in any business area. By setting realistic goals for growth and profitability, budgets can show where startups may be taking on too much risk.

How do I create a budget for a startup?

You can create a budget for your startup in seven simple steps: Determine all your essential one-time costs and capital expenditures. List all your fixed and variable monthly expenses. Estimate funding from investments, bank loans, and savings. Estimate your expected monthly revenue. Calculate a break-even point.

What should a startup spend on?

Startups generally factor in key expenses in their budget, like advertising, content marketing, technology, and automation software. The money gained from your gross revenue should fund your marketing budget.