Free Student Budget Word Templates - Page 2

What are Student Budget Templates?

Student Budget Templates are pre-designed spreadsheets or documents that help students track their expenses, income, and savings. These templates assist students in managing their finances effectively.

What are the types of Student Budget Templates?

There are various types of Student Budget Templates available to cater to different needs. Some common types include:

Monthly Budget Template

Weekly Budget Template

College Expense Tracker Template

Savings Goal Template

How to complete Student Budget Templates

Completing Student Budget Templates is a straightforward process. Here are some steps to help you get started:

01

Enter your income sources such as part-time job, allowances, or scholarships

02

List all your expenses including tuition fees, rent, groceries, and entertainment

03

Allocate budget for each expense category based on your priorities

04

Track your actual spending and compare it to the budgeted amount regularly

05

Make adjustments as needed to stay within your budget

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What college students spend the most money on?

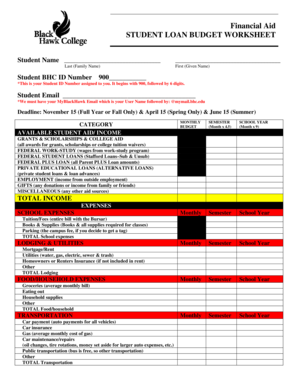

College students are estimated to spend nearly $10 billion on clothing for the 2021-2022 school year.Take a look at what individual college students planned to spend on average during the 2021 – 2022 back-to-school shopping season: Electronics: $306.41. Furnishings: $164.38. Clothes: $158.98. School supplies: $83.56.

How do you budget for beginners?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What is a student budget?

While the number is dependent on a range of factors, the average amount of spending money for a college student is $2,000 per year or about $200 per month. When figuring out how much money to set aside and deciding how you and your child should split the cost, here are some guidelines and tips to follow.

What is a good college student monthly budget?

Step 4: Create a College Student Budget Many people use the 50/30/20 rule, which calls for putting 50% of your total after-tax income toward needs, 30% toward wants, and 20% toward savings and other financial goals.

How much fun money per month?

Some experts suggest the magic number is 10% of your monthly income, after taxes. I think the right amount should be somewhere in the range of 5-10% per month. Under this fun money umbrella are trips to the bar, the movies, weekend road trips, spa days, etc.

What is a good college student budget for the academic year?

Student budgeting is the continual process of a student organizing their finances to ensure financial stability for short-term, mid-term, and long-term financial goals. By keeping finances in order, students ensure they can pay and manage living expenses like rent, food, bills, tuition, and student loans.