Free Collection Letter Word Templates - Page 2

What are Collection Letter Templates?

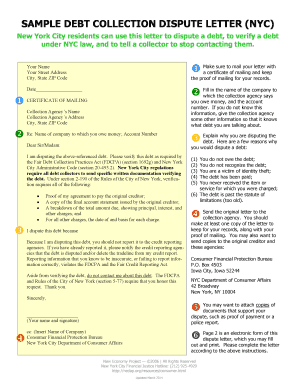

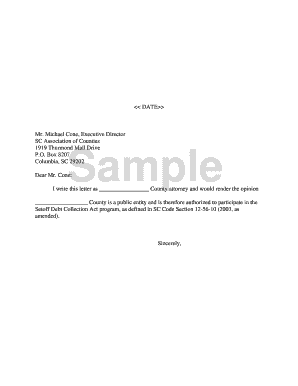

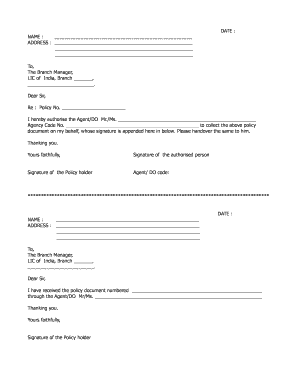

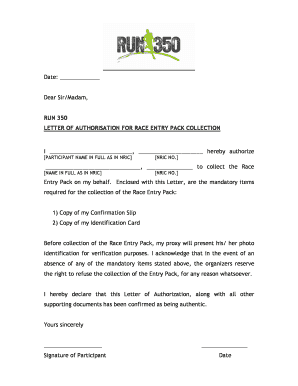

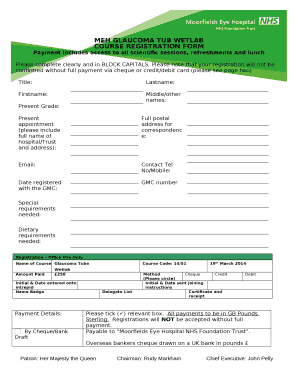

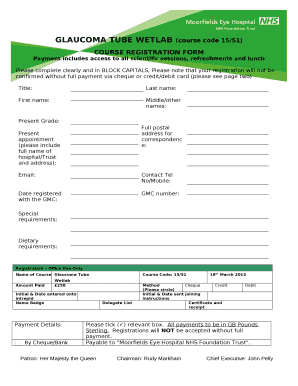

Collection Letter Templates are pre-written documents that businesses use to communicate with clients who have overdue payments. These templates provide a structured format for sending reminders and requests for payment.

What are the types of Collection Letter Templates?

There are several types of Collection Letter Templates that businesses can utilize depending on the stage of the debt collection process. Some common types include:

How to complete Collection Letter Templates

Completing Collection Letter Templates is a simple and straightforward process. By following these steps, you can effectively communicate with clients and encourage them to settle their outstanding balances:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.