Free Information Letter Word Templates - Page 4

What are Information Letter Templates?

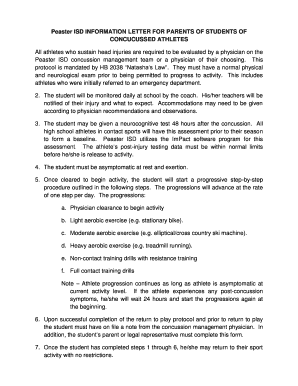

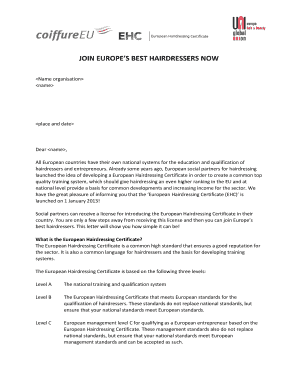

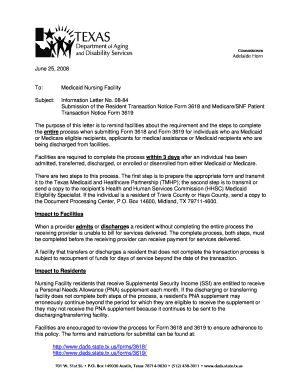

Information Letter Templates are pre-designed documents that contain formatted placeholders for important information such as recipient's name, address, date, and content. These templates save time and effort by providing a structured format for writing letters.

What are the types of Information Letter Templates?

There are several types of Information Letter Templates available, including but not limited to: Business Letter Templates, Cover Letter Templates, Reference Letter Templates, Formal Letter Templates, and Personal Letter Templates.

How to complete Information Letter Templates

To complete Information Letter Templates effectively, follow these simple steps: 1. Open the template in a document editing tool. 2. Fill in the placeholders with relevant information. 3. Review the letter for accuracy and make any necessary edits. 4. Save or print the completed letter for distribution.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.