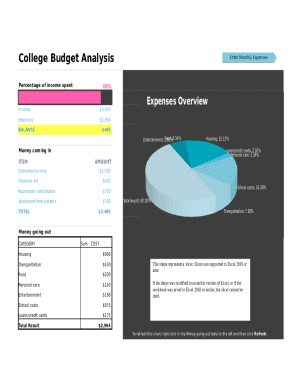

College Student Budget Template

What is College Student Budget Template?

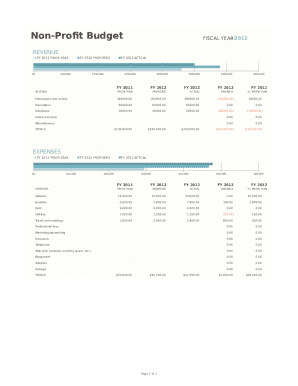

A College Student Budget Template is a tool that helps students track and manage their finances effectively. It usually includes sections for income, expenses, savings, and personal spending.

What are the types of College Student Budget Template?

There are several types of College Student Budget Templates available, including:

Basic Budget Template

Detailed Budget Template

Semester Budget Template

How to complete College Student Budget Template

Completing a College Student Budget Template is easy with these steps:

01

Gather all your financial information

02

Fill in the template with your income and expenses

03

Review and adjust as needed before finalizing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a good monthly budget for a college student?

While the number is dependent on a range of factors, the average amount of spending money for a college student is $2,000 per year or about $200 per month. When figuring out how much money to set aside and deciding how you and your child should split the cost, here are some guidelines and tips to follow.

How do you calculate a budget for a college student?

How to create a budget while in college Calculate your net income. List monthly expenses. Organize your expenses into fixed and variable categories. Determine average monthly costs for each expense. Make adjustments.

What is a realistic budget for a college student?

What is a good college student budget for the academic year? College Board data shows that students who spend moderately should prepare a 12-month budget of approximately $27,200. An acceptable lower budget would be around $18,220 per year.

How should a college student budget their money?

Here are seven college budgeting tips with insight from financial experts. Track Your Spending. Set Long-Term Financial Goals. Build Credit Into Your Budget. Create an Income Source. Spend Below Your Means. Keep Searching for Scholarships. Set Aside Savings.

What does a college student need to budget for?

In addition to tuition, you'll have to budget for other college costs, like transportation and school supplies. Make a list of likely expenses, estimate the cost and agree who pays for what. (See more on expenses below.) FAFSA and taxes.

What is the basic budget for a college student?

What is a good college student budget for the academic year? College Board data shows that students who spend moderately should prepare a 12-month budget of approximately $27,200. An acceptable lower budget would be around $18,220 per year.

Related templates