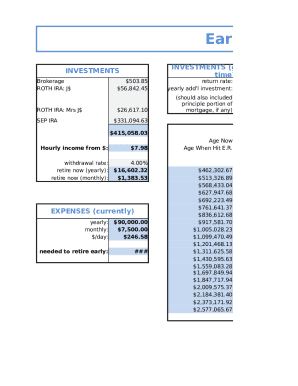

What is Early Retirement Spreadsheet?

An Early Retirement Spreadsheet is a tool that helps individuals track their income, expenses, savings, and investments with the goal of retiring early. It allows users to calculate their retirement age based on their financial goals and current financial situation.

What are the types of Early Retirement Spreadsheet?

There are several types of Early Retirement Spreadsheets available to users, including:

Basic Expense Tracker Spreadsheet

Investment Portfolio Tracker Spreadsheet

Retirement Savings Calculator Spreadsheet

Retirement Income Planner Spreadsheet

How to complete Early Retirement Spreadsheet

Completing an Early Retirement Spreadsheet is a straightforward process that involves the following steps:

01

Gather all your financial information, including income, expenses, savings, and investments.

02

Input all the relevant data into the designated fields of the spreadsheet.

03

Review the calculations and projections to ensure accuracy and adjust as needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Early Retirement Spreadsheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 25% retirement rule?

Basically, the Rule of 25x says that at retirement, you should have 25 times your planned annual spending saved. That means if you plan to spend $50,000 in your first year in retirement, you should have $1,250,000 in retirement assets when you walk away from your job.

How do I make a retirement spreadsheet?

A good retirement spreadsheet template should include the following: Savings that you have currently. Your investments and your net worth. Your age at the time of retirement or years to your retirement. The rate of your yearly withdrawal. Your investment return rate. Your projected income.

Is saving 25% for retirement too much?

There is a general rule of thumb: When saving for retirement, most experts recommend an annual retirement savings goal of 10% to 15% of your pre-tax income.

How to retire early for dummies?

7 Steps to Retire Early Determine how much income you'll need in retirement. Figure out how much will come from Social Security and other fixed sources. Calculate your "number." Take stock of where you stand. Make a savings and investment plan. Account for healthcare and other concerns. Stick to the plan.

What is the formula for early retirement?

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

Why the 4% rule no longer works for retirees?

The traditional 4% rule has served retirees well for decades but may no longer be relevant due to rising costs and increased market volatility. Retirees should consider using a rate closer to 3.3% withdrawal rate instead, as well as looking into other sources of income.

Related templates