Financial Power Of Attorney Texas

What is Financial Power Of Attorney Texas?

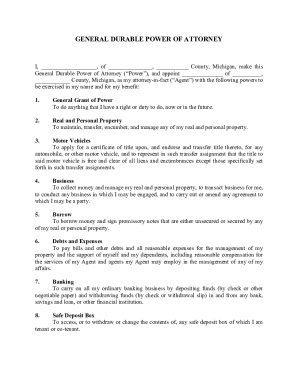

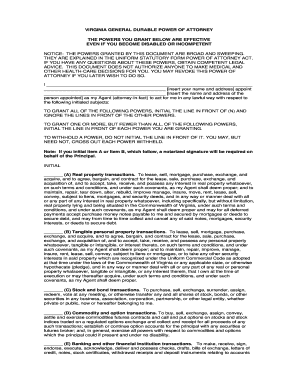

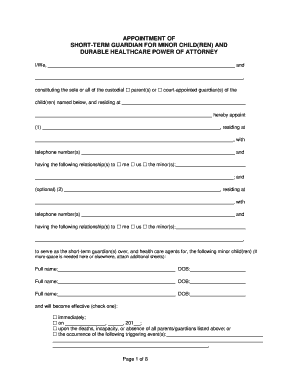

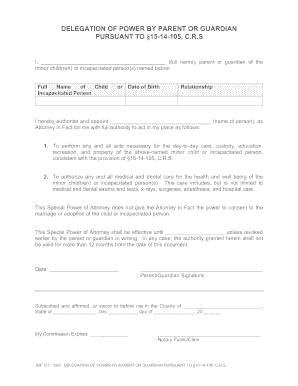

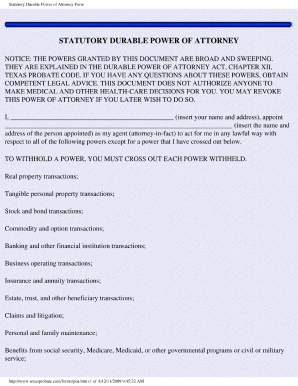

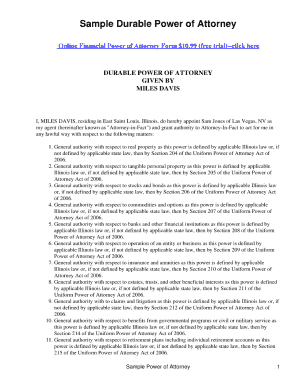

A Financial Power of Attorney in Texas is a legal document that grants someone the authority to manage your financial affairs if you become incapacitated or unable to handle them yourself. This person, known as your agent or attorney-in-fact, will have the power to make financial decisions on your behalf, including paying bills, managing investments, and handling other financial matters.

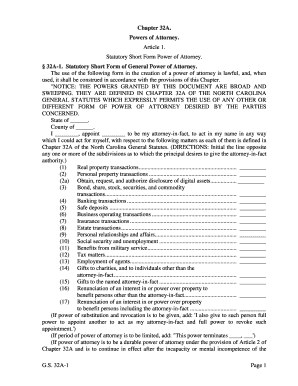

What are the types of Financial Power Of Attorney Texas?

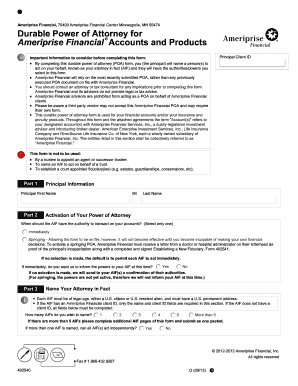

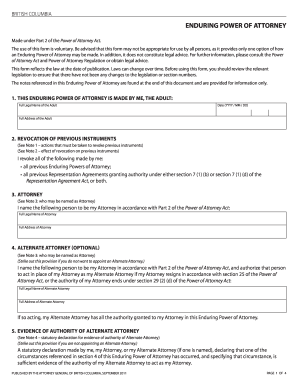

In Texas, there are two main types of Financial Power of Attorney: Durable Power of Attorney and Springing Power of Attorney. - Durable Power of Attorney: This type remains in effect even if you become incapacitated. - Springing Power of Attorney: This type only becomes effective once you are declared incapacitated by a physician or other designated party.

How to complete Financial Power Of Attorney Texas

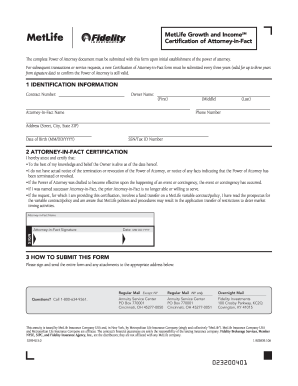

To complete a Financial Power of Attorney in Texas, follow these steps: 1. Determine the type of Power of Attorney you need (durable or springing). 2. Choose your agent or attorney-in-fact. 3. Draft the document or use a template. 4. Sign the document in the presence of a notary public. 5. Provide copies to relevant parties, such as financial institutions and family members.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.