Business Loan Application Form Doc - Page 2

What is Business loan application form doc?

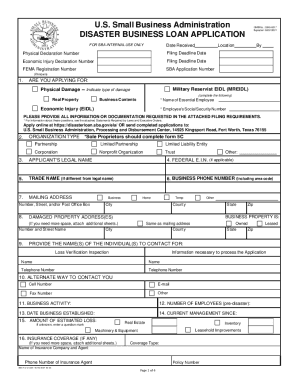

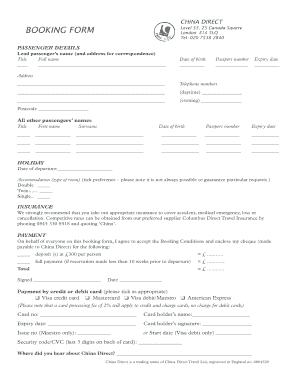

The Business loan application form doc is a formalized document that businesses use to apply for loans from financial institutions or lenders. It includes details about the business, its financial situation, loan amount requested, purpose of the loan, and other relevant information required by the lender.

What are the types of Business loan application form doc?

There are several types of Business loan application form docs that businesses may encounter, including: 1. Standard Business loan application form 2. Small Business Administration (SBA) loan application form 3. Equipment loan application form 4. Working capital loan application form 5. Commercial real estate loan application form

How to complete Business loan application form doc

Completing a Business loan application form doc can be a straightforward process if you follow these steps: 1. Gather all necessary documentation, such as financial statements, business plan, and tax returns. 2. Fill out the form accurately and completely, providing detailed information about your business and financial situation. 3. Double-check the form for any errors or missing information before submitting it to the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.