Bank Rating Form Templates

What are Bank Rating Form Templates?

Bank Rating Form Templates are standardized forms used by financial institutions to evaluate the creditworthiness and risk level of potential borrowers. These forms help banks make informed decisions when granting loans or lines of credit.

What are the types of Bank Rating Form Templates?

There are several types of Bank Rating Form Templates, including:

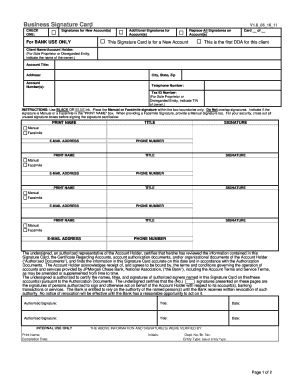

Commercial Loan Rating Form

Personal Loan Rating Form

Business Credit Rating Form

Mortgage Loan Rating Form

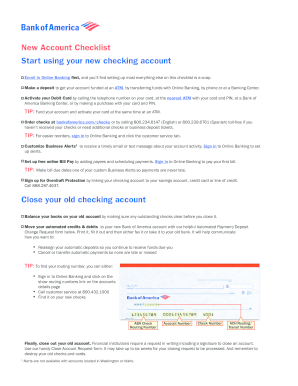

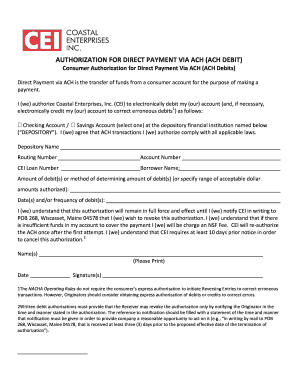

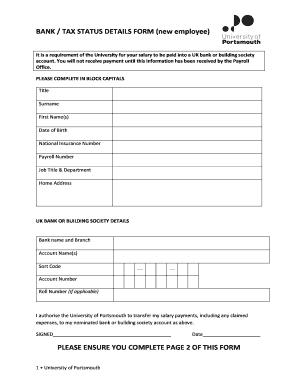

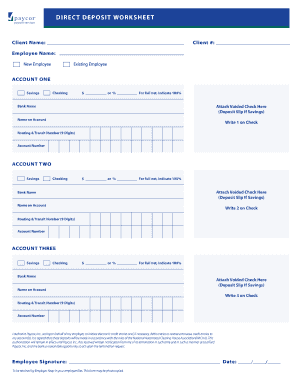

How to complete Bank Rating Form Templates

Completing Bank Rating Form Templates is a straightforward process that involves the following steps:

01

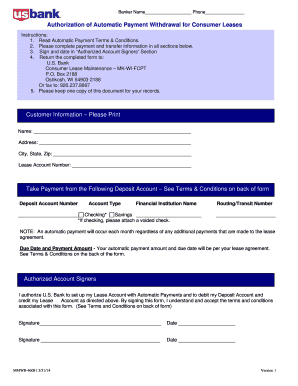

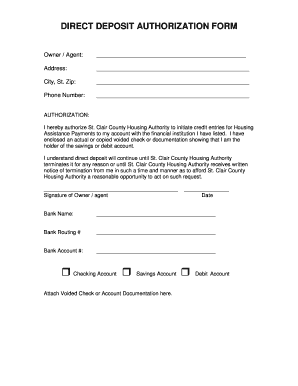

Fill in personal or business information accurately

02

Provide financial statements and income documentation

03

Answer questions about credit history and loan purpose

04

Review and double-check all information for accuracy

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bank Rating Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the different bank ratings?

How a Bank Credit Rating Works Ratings by AgencyMoody'sFitchMeaningAAUpper-medium quality, low riskBaaBBBMedium quality, moderate riskBaBBSpeculative quality, substantial risk7 more rows • May 7, 2022

What is a B+ bank rating?

This rating signifies that the issuer is relatively risky, with a higher than average chance of default. B1/B+ are ratings just below investment grade but are the highest rating in the non-investment grade bracket. Moody's Investors Service uses B1, while S&P Global Ratings and Fitch Ratings use B+.

What is a bank account rating?

What is a Bank Rating? A bank rating is a measure of the average minimum balance as kept in a business bank account over a 3 month long period. Hence a $10,000 balance| will rate as a Low-5, a $5,000 balance will rate as a Mid-4, and a $999 balance will rate as a High-3, etc.

Is BBB a good bank rating?

Ratings of BB or lower are considered “junk" ratings. Agencies with scores that fall between the two categories are average but may be under observation by the credit rating agencies. Ratings lower than BBB are considered “non-investment grade," while those between BBB and AAA are considered “investment grade."

Is there a bank rating system?

The Federal Deposit Insurance Corporation (FDIC) issues a bank rating on a scale of one to five, with one being the best possible rating and five the lowest.

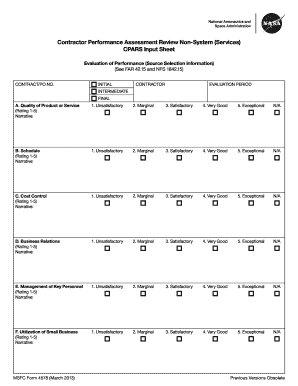

How do I create a bank form?

How to Create Banking Forms Look for the Suitable Template or Format. Specify the Type of Form. Input the Required Information from that Form Type. Leave Some Blanks or Spaces for Writing. Improve the Presentation. Adjust for Necessary Changes.

Related templates