Partnership Tax Return Example - Page 2

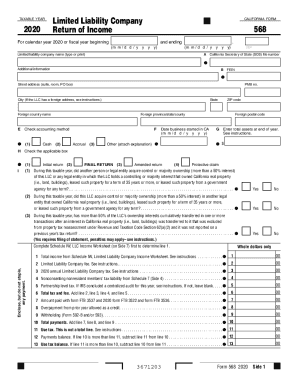

What is Partnership tax return example?

A Partnership tax return example is a tax form that partnerships use to report their income, deductions, and other financial information to the IRS. This document helps the IRS assess the partnership's tax liability for the year.

What are the types of Partnership tax return example?

There are several types of Partnership tax return examples, including Form 1065 for general partnerships, Form 1065-B for electing large partnerships, and Form 1065-A for certain partnerships with publicly traded partnerships interests. Each form is used based on the specific type of partnership and its tax requirements.

How to complete Partnership tax return example

Completing a Partnership tax return example can seem daunting, but with careful attention to detail, it can be done efficiently. Here are some steps to help you through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.