Bank Account Garnishment Laws By State - Page 2

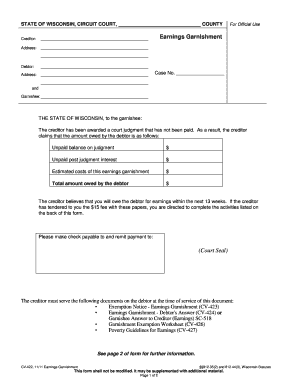

What is Bank account garnishment laws by state?

Bank account garnishment laws by state refer to the regulations that dictate how creditors can legally access funds in a debtor's bank account to satisfy outstanding debts. These laws vary from state to state and outline the specific procedures and limitations that creditors must follow.

What are the types of Bank account garnishment laws by state?

1. Pre-judgment garnishment: This type of garnishment occurs before a court judgment is made against the debtor. 2. Post-judgment garnishment: This type of garnishment occurs after a court judgment has been obtained by the creditor. 3. Wage garnishment: Some states allow creditors to garnish a portion of a debtor's wages to satisfy a debt. 4. Non-wage garnishment: In some states, creditors can also garnish other types of income, such as rental income or retirement benefits.

How to complete Bank account garnishment laws by state

To navigate bank account garnishment laws by state effectively, follow these steps: 1. Understand the specific laws in your state regarding garnishment. 2. Communicate with your creditor or seek legal advice if you are facing garnishment. 3. Keep accurate records of your finances and any communication with creditors. 4. Consider negotiating a payment plan or settlement with your creditor to avoid garnishment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.