Can An Employer Garnish Wages Without A Court Order

What is Can an employer garnish wages without a court order?

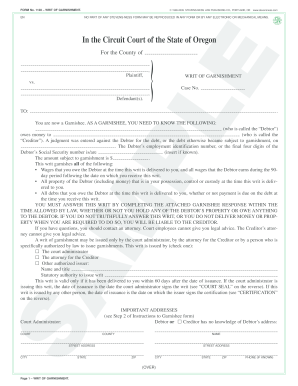

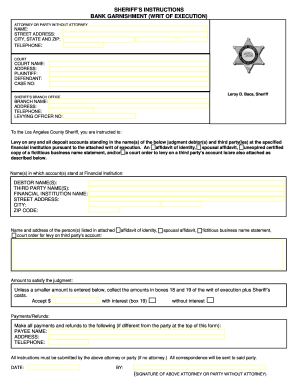

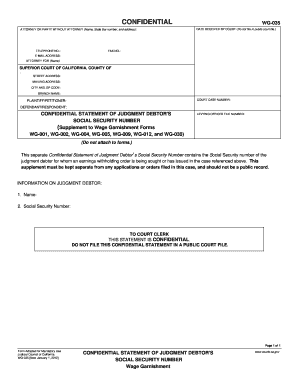

When an employer garnishes wages without a court order, it means they are withholding a portion of an employee's earnings to pay off a debt or legal obligation without first obtaining permission from a court.

What are the types of Can an employer garnish wages without a court order?

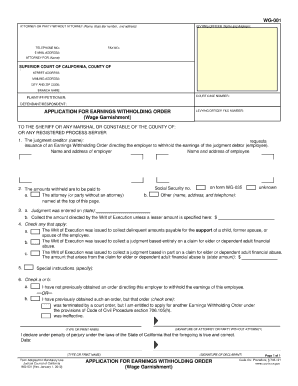

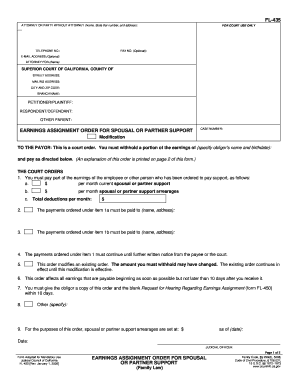

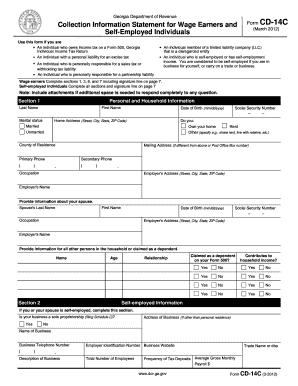

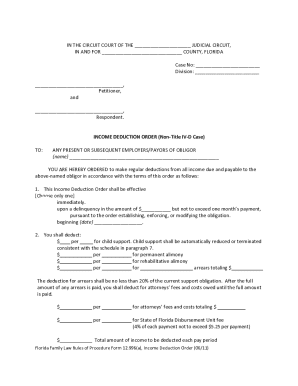

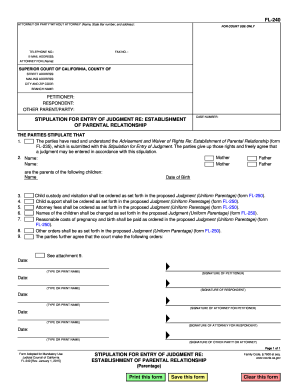

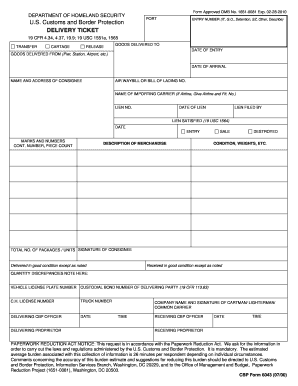

There are mainly two types of wage garnishment without a court order: administrative wage garnishment and wage assignments.

Administrative wage garnishment

Wage assignments

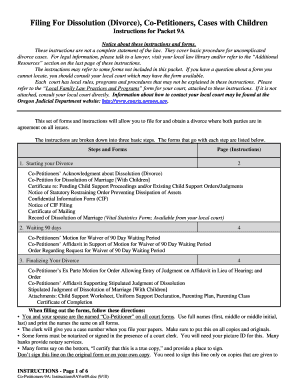

How to complete Can an employer garnish wages without a court order

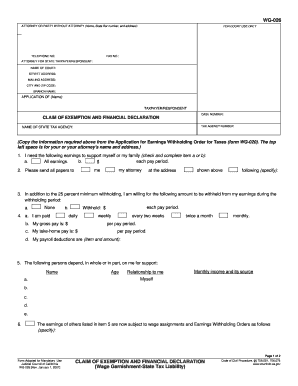

To complete the process of wage garnishment without a court order, the employer needs to follow specific legal procedures and provide the employee with proper notification.

01

Obtain verified information regarding the debt or legal obligation

02

Notify the employee in writing about the wage garnishment

03

Withhold the designated amount from the employee's wages

04

Remit the withheld amount to the appropriate entity

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor you need to get your documents done efficiently and hassle-free.

Video Tutorial How to Fill Out Can an employer garnish wages without a court order

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

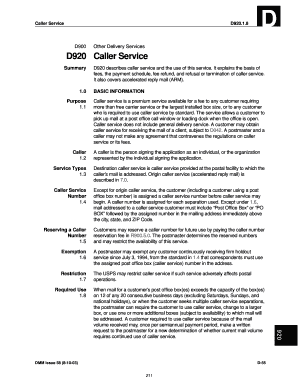

What are the garnishment laws in Nebraska?

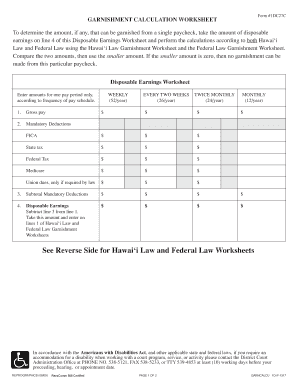

In Nebraska, for any workweek, a creditor may garnish the lesser of: 25% of your disposable earnings, or 15% of your disposable earnings if you're the head of a family, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

How does wage garnishment work in NC?

A wage garnishment is a legal document that requires the employer of a taxpayer to withhold funds from the taxpayer's wages, salaries, or non-wage payments (contract payments, commissions, rents, royalties, etc.) and submit those funds to the Department in order to pay an unpaid tax liability.

What is 30 times federal minimum wage?

Wage Garnishment Limits As of March 21, 2022, the federal minimum wage is $7.25, and 30 times that is $217.50.

What is the most the government can garnish your wages?

Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

What are the garnishment laws in Oklahoma?

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.

What are the garnishment laws in Illinois?

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.