Garnishments Payroll

What is Garnishments payroll?

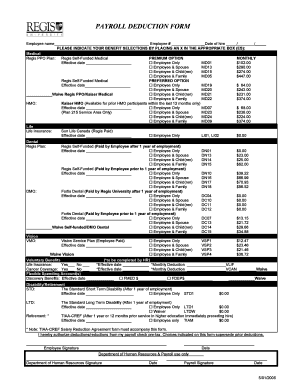

Garnishments payroll refers to the process where an employer deducts a portion of an employee's wages to satisfy a debt or legal obligation. This can include child support payments, court-ordered judgments, or tax levies.

What are the types of Garnishments payroll?

There are several types of garnishments that can affect an employee's payroll. Some common types include:

Child support garnishments

Wage garnishments for debt repayment

Tax levies

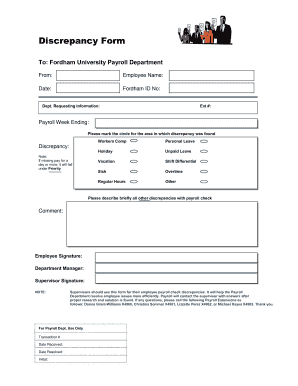

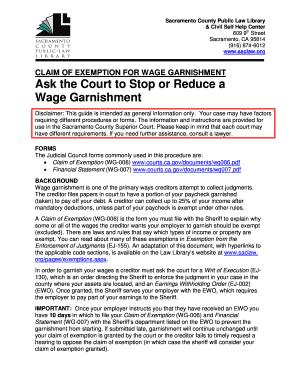

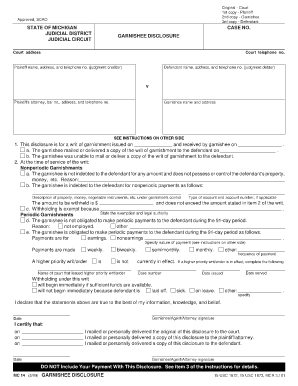

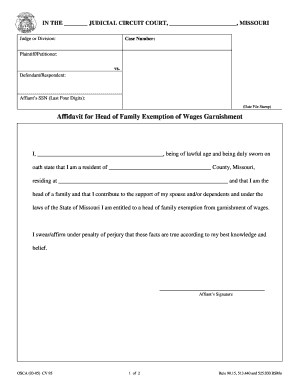

How to complete Garnishments payroll

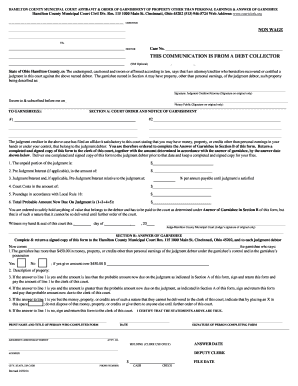

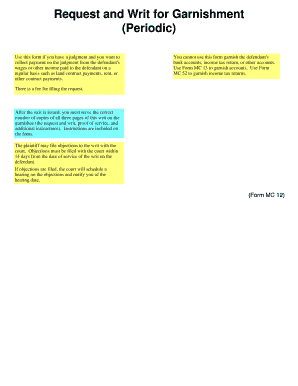

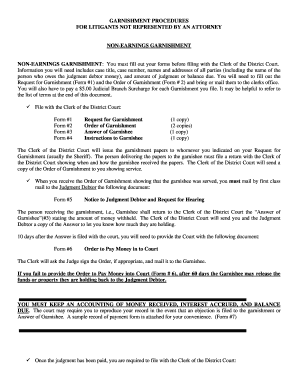

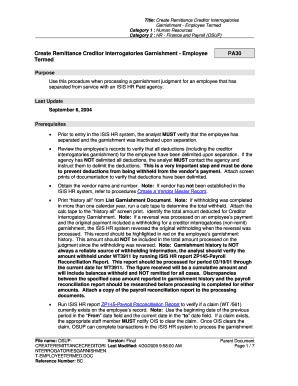

Completing Garnishments payroll requires careful attention to detail to ensure compliance with legal requirements. Here are the steps to follow:

01

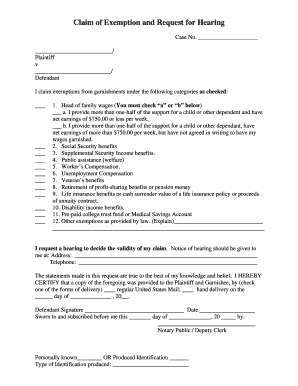

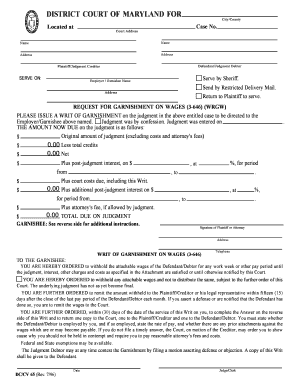

Identify the type of garnishment and the amount to be deducted

02

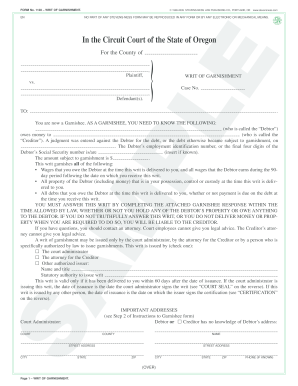

Notify the employee of the garnishment and provide relevant documentation

03

Withhold the specified amount from the employee's wages and remit it to the appropriate authority

04

Maintain accurate records of all garnishment payments and communications

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Garnishments payroll

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How does wage garnishment affect you?

Wage garnishment is a method of debt collection in which part of your earnings are withheld each pay period and used to pay back your creditors. Wage garnishment can affect both private debts, such as a delinquent loan or credit card bill, and public debt, such as taxes owed to the government.

What is the most common type of garnishment?

Types of wage garnishment Child support is the most common wage garnishment in the United States, but it's not the only reason an employer may receive a garnishment order. Other examples include: Creditor garnishments.

How do I remove a garnishment from my credit report?

If a court has awarded judgment to your creditor and garnishment is part of the plan, here are some potential ways to get rid of it. Pay Off the Debt. Work With Your Creditor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.

What are the negatives of wage garnishment?

Wage garnishments negatively impact your credit report and credit score. However, creditors themselves do not typically report their decision to garnish your wages to credit agencies. Instead, they will report your accounts as being defaulted or closed.

Is having your wages garnished good or bad?

A wage garnishment order affects your finances, making it difficult to fulfill your financial responsibilities. In addition, it indirectly impacts your credit history and reduces your creditworthiness to lenders in the future.

What is an example of a garnish?

Simple garnishes such as chopped herbs, decoratively cut lemons, parsley and watercress sprigs, browned breadcrumbs, sieved hard-cooked eggs, and broiled tomatoes are appropriate to a wide variety of foods. their purpose is to provide contrast in colour, texture, and taste, and to give a finished appearance to the dish