Wage Garnishment Laws By State

What is Wage garnishment laws by state?

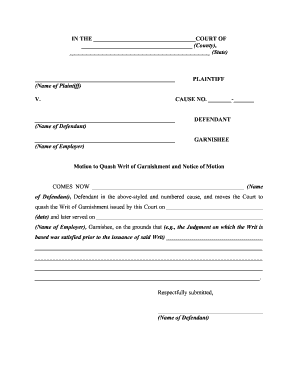

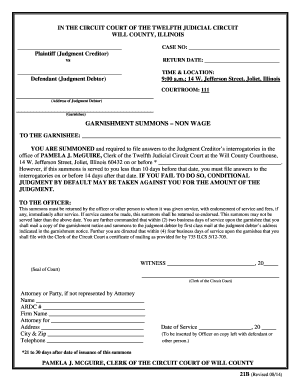

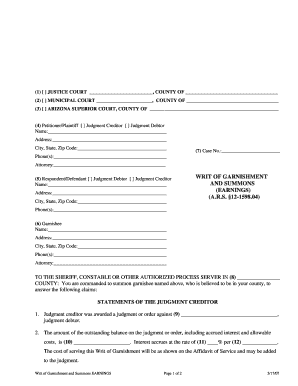

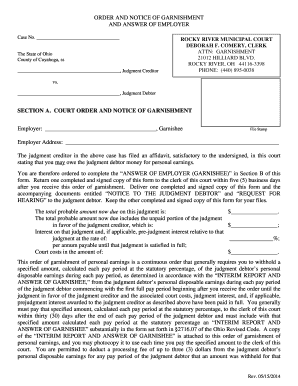

Wage garnishment laws by state refer to the regulations and rules that govern how much of an individual's wages can be legally withheld to satisfy debts. Each state has its own specific laws regarding wage garnishment, including the maximum percentage of wages that can be garnished and the types of debts that qualify for garnishment.

What are the types of Wage garnishment laws by state?

There are several types of wage garnishment laws by state, including:

Child support garnishment

Student loan garnishment

Tax debt garnishment

Credit card debt garnishment

How to complete Wage garnishment laws by state

To successfully navigate wage garnishment laws by state, follow these steps:

01

Understand the specific laws in your state regarding wage garnishment

02

Determine the type of debt that is subject to garnishment

03

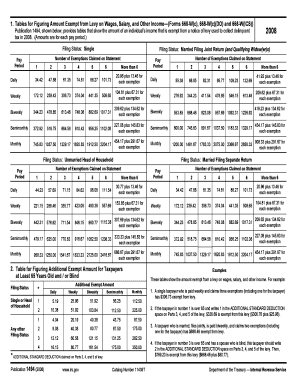

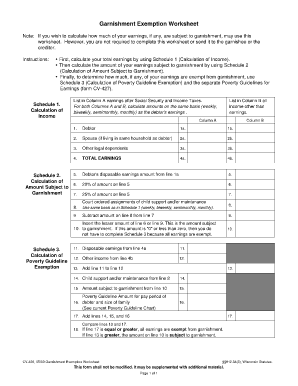

Calculate the maximum amount that can be garnished from your wages

04

Seek legal assistance if needed to protect your rights

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Wage garnishment laws by state

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

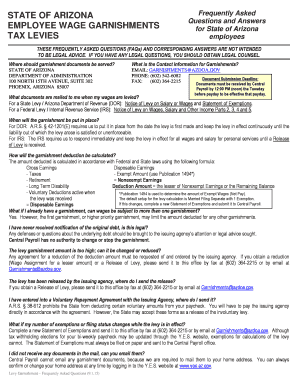

How do I stop a garnishment in Arkansas?

Filing bankruptcy will stop the garnishment process immediately. Once you file, most employers will stop the garnishment the same day they get a case number. The creditor also has to stop the same day you file. If any money does get garnished after the date you file, it has to promptly be returned to you.

What is the most that can be garnished from wages?

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

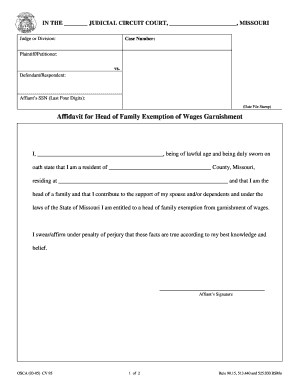

What is the exemption for wage garnishment in Arkansas?

Under Arkansas law, if you're a mechanic or laborer you can exempt the first 60 days of your wages as long as it's less than the personal property exemption. That personal property exemption is $500 if you're married or head of household. Otherwise, the exemption is $200.

What is the most the government can garnish your wages?

Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

How much can Arkansas garnish wages?

GARNISHMENT IN ARKANSAS A writ of garnishment is a legal document that allows the creditor, under Arkansas law, to forcibly take from your employer up to twenty-five percent (25%) of your wages.

What states don't allow bank garnishments?

What States Prohibit Bank Garnishment? Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. ing to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.