Garnished Wages Without Notification

What is Garnished wages without notification?

Garnished wages without notification is when a portion of your wages is withheld by an employer to satisfy a debt or legal obligation without prior notice.

What are the types of Garnished wages without notification?

There are two main types of garnished wages without notification: wage garnishment for unpaid taxes and wage garnishment for unpaid child support.

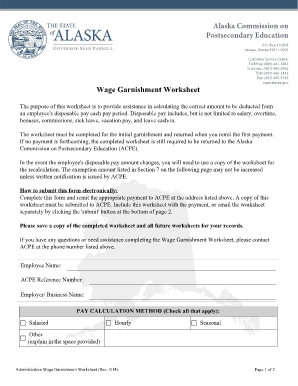

Wage garnishment for unpaid taxes

Wage garnishment for unpaid child support

How to complete Garnished wages without notification

If you find yourself facing garnished wages without notification, follow these steps to address the situation:

01

Contact your employer to understand the reason for the wage garnishment.

02

Seek legal advice to explore your options and rights.

03

Negotiate a payment plan with the creditor or agency responsible for the garnishment.

04

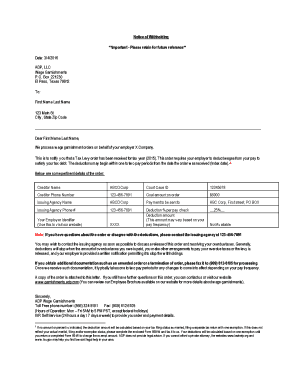

Stay informed and keep track of all communication and documentation related to the garnishment.

05

Consider using pdfFiller to create, edit, and share necessary documents efficiently.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Garnished wages without notification

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

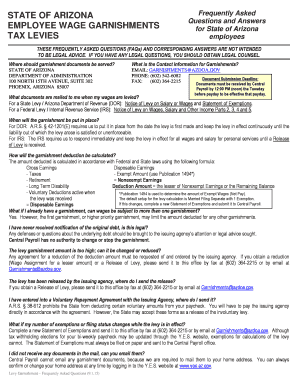

Can IRS garnish wages without warning?

Before the IRS takes any collections actions, it must follow procedures to ensure yourcollections due process rights. That means the IRS can't start garnishing your wages without warning to collect back taxes. You'll receive IRS notices stating that you have a balance due.

How long can your wages be garnished in MN?

If you do not return the exemption notice and bank statements to the creditor's attorney within 10 days of receiving notice of the intent to garnish your wages, the creditor can begin to garnish money from your wages, and can continue to do so for up to 70 days.

How do I stop a wage garnishment in Minnesota?

There are four ways to stop a garnishment in Minnesota: (1) claim an exemption. (2) negotiate a settlement. (3) vacate the judgment. and (4) file bankruptcy.

How do I stop a wage garnishment in Wisconsin?

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep. (If you're unable to pay your bills, learn which debts get wiped out in Chapter 7 bankruptcy.)

How do you write a letter to stop wage garnishment?

Example Letter to Stop Wage Garnishment Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

What is the most wages can be garnished?

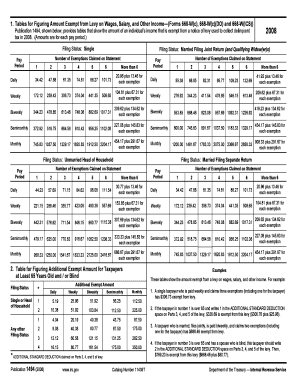

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.