Payroll Garnishment Rules

What is Payroll garnishment rules?

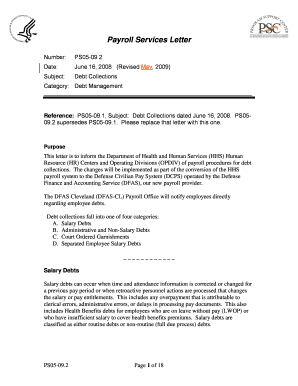

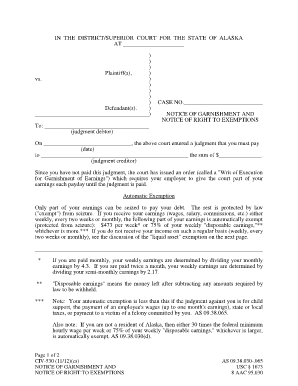

Payroll garnishment rules refer to the regulations that dictate how employers must handle a court-ordered deduction from an employee's wages to satisfy a debt.

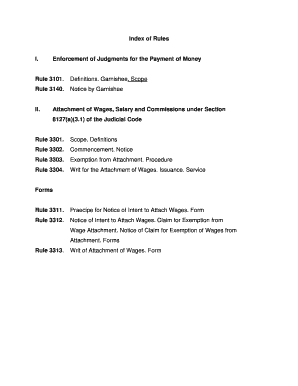

What are the types of Payroll garnishment rules?

There are generally three types of Payroll garnishment rules:

Wage garnishment for child support

Wage garnishment for unpaid taxes

Wage garnishment for consumer debts

How to complete Payroll garnishment rules

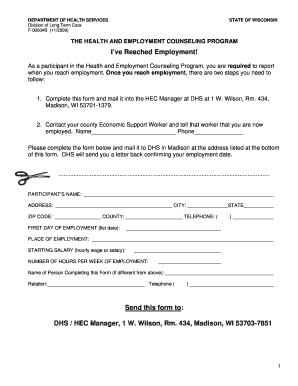

To complete Payroll garnishment rules successfully, follow these steps:

01

Determine the type of garnishment order

02

Calculate the correct amount to withhold from the employee's wages

03

Notify the employee of the garnishment

04

Withhold the specified amount from the employee's wages

05

Remit the garnished amount to the appropriate entity

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payroll garnishment rules

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

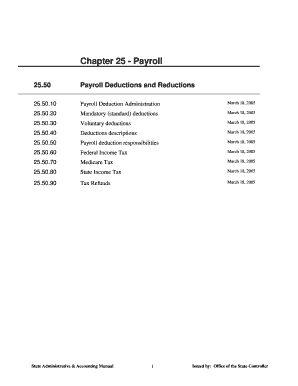

What is 30 times federal minimum wage?

Wage Garnishment Limits As of March 21, 2022, the federal minimum wage is $7.25, and 30 times that is $217.50.

What is the law for garnishment in Indiana?

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

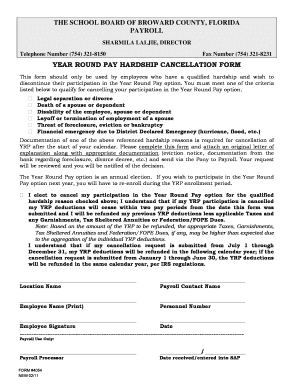

Is having your wages garnished good or bad?

A wage garnishment order affects your finances, making it difficult to fulfill your financial responsibilities. In addition, it indirectly impacts your credit history and reduces your creditworthiness to lenders in the future.

What is the most common type of garnishment?

Types of wage garnishment Child support is the most common wage garnishment in the United States, but it's not the only reason an employer may receive a garnishment order. Other examples include: Creditor garnishments.

What is the most the government can garnish your wages?

Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

What is the most wages can be garnished?

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.