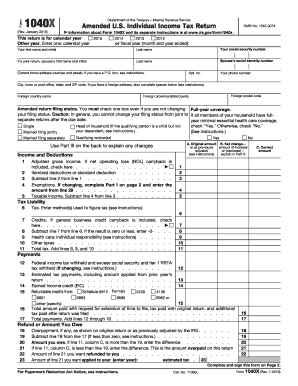

1040 Form 2013

What is 1040 Form 2013?

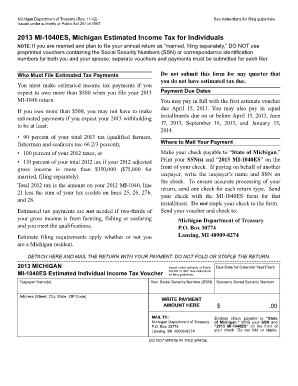

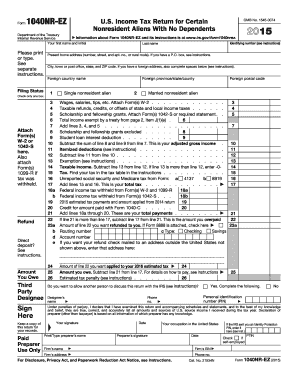

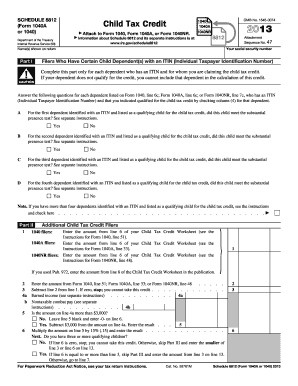

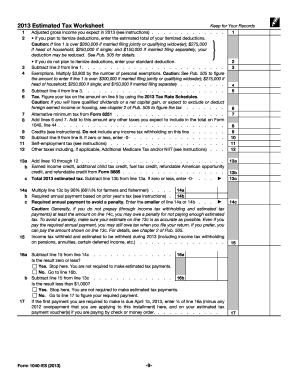

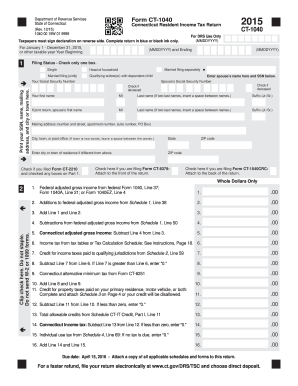

The 1040 Form 2013 is an IRS tax form used by individuals to report their income and file their federal income tax return for the year 2013. It is the standard form for personal tax filing and includes various sections to report income, deductions, credits, and calculate the final tax liability or refund.

What are the types of 1040 Form 2013?

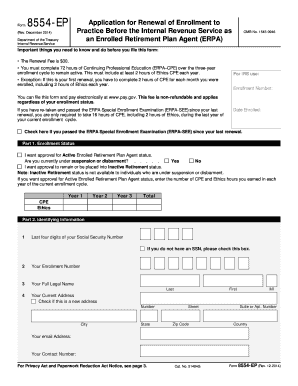

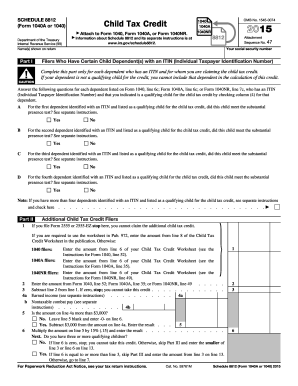

There are several types of 1040 Form 2013 depending on the taxpayer's filing status and income sources. The main types include:

How to complete 1040 Form 2013

Completing the 1040 Form 2013 may seem daunting, but with proper guidance, it can be easily done. Here are the steps to complete the form:

In order to simplify the process of filling out tax forms, users can take advantage of pdfFiller. pdfFiller offers a user-friendly online platform that empowers individuals to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently complete your 1040 Form 2013 and other tax-related documents.