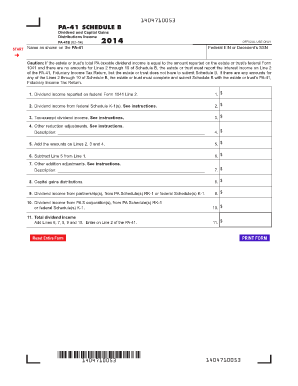

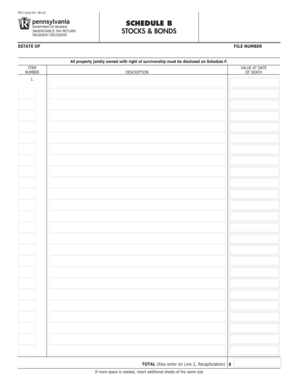

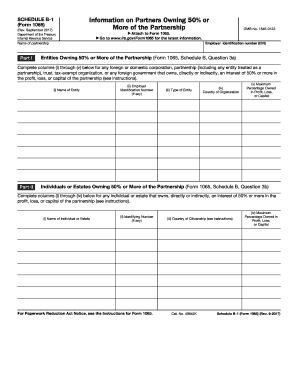

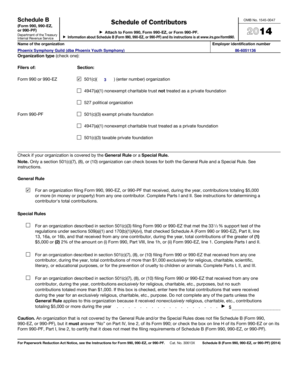

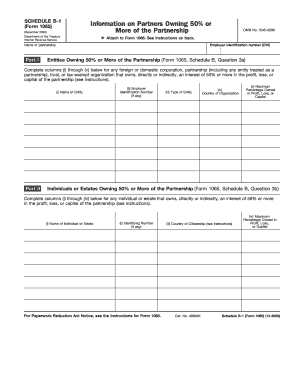

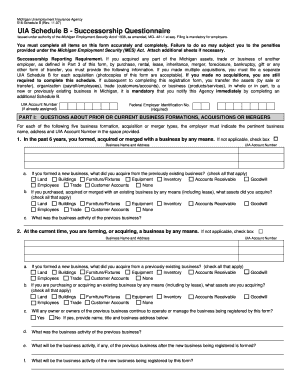

2014 Schedule B

What is 2014 schedule b?

2014 Schedule B is a form used by taxpayers to report interest and ordinary dividends received during the tax year. It is filed along with the federal income tax return. The Schedule B form is important for individuals who have earned income from interest or dividends on their investments or savings accounts.

What are the types of 2014 schedule b?

There are two types of 2014 Schedule B: 1. Schedule B (Form 1040A or 1040): This form is used by taxpayers who are required to report interest and dividend income of more than $1,500 or who have certain foreign accounts or trusts. 2. Schedule B (Form 1040EZ): This form is used by taxpayers who have interest income of $1,500 or less and who don't need to itemize deductions or claim any adjustments to income.

How to complete 2014 schedule b

To complete the 2014 Schedule B form, follow these steps: 1. Gather all necessary documents: collect your financial statements, including bank account statements and investment statements that show interest and dividend income. 2. Fill in the personal information: provide your name, address, and social security number. 3. Enter interest income: report the total amount of interest income received during the tax year. 4. Enter dividend income: report the total amount of ordinary dividends received during the tax year. 5. Provide additional details: if required, disclose any foreign accounts or trusts. 6. Calculate and sign: follow the instructions on the form to calculate your taxable income and sign the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.