Budget Calculator App

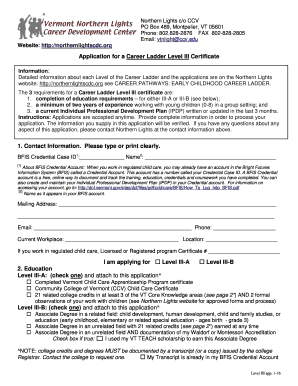

What is a budget calculator app?

A budget calculator app is a digital tool that helps individuals or businesses track their income and expenses, create a budget, and manage their finances more effectively. It allows users to input their financial information and then calculates the total budget based on predefined categories.

What are the types of budget calculator app?

There are various types of budget calculator apps available in the market to suit different financial needs. Some common types include:

Personal finance budget apps

Business budget planning apps

Expense tracking apps

Saving goal calculators

How to complete a budget calculator app

Completing a budget calculator app is easy and straightforward. Here are the steps to follow:

01

Download and install a budget calculator app from a trusted app store

02

Create an account or log in to the app

03

Input your income and expenses details

04

Set up budget categories and allocate funds accordingly

05

Track your spending and adjust your budget as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 50 30 30 budget rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

How do I make a budget tracker sheet?

A simple, step-by-step guide to creating a budget in Google Sheets Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget.

Does Microsoft have a budget template?

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

Does Microsoft Word have a budget template?

Step 1: Title. Since we need to create a budget in Microsoft Word, we need to open a new document in the Word file. Go to the File menu, select New and open a blank document from the small window. Type a new Title “Budget Planner”.

How do I create a budget tracker spreadsheet?

How to Create a Budget Spreadsheet in Excel Identify Your Financial Goals. Determine the Period Your Budget Will Cover. Calculate Your Total Income. Begin Creating Your Excel Budget. Enter All Cash, Debit and Check Transactions into the Budget Spreadsheet. Enter All Credit Transactions.

Is there a budget spreadsheet in Excel?

Creating a budgeting plan for your household can feel overwhelming and hard, but Excel can help you get organized and on track with a variety of free and premium budgeting templates.

Related templates