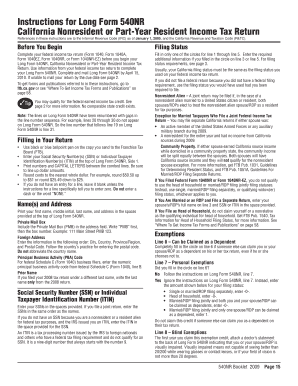

What is california form 540 instructions 2016?

California Form 540 Instructions 2016 is a comprehensive guide provided by the California Franchise Tax Board (FTB) to help taxpayers understand how to fill out and file their state income tax return for the year 2016. It provides detailed instructions on various aspects of the form, including how to report income, deductions, and credits. The instructions also explain key tax laws and regulations that taxpayers need to be aware of while preparing their tax return.

What are the types of california form 540 instructions 2016?

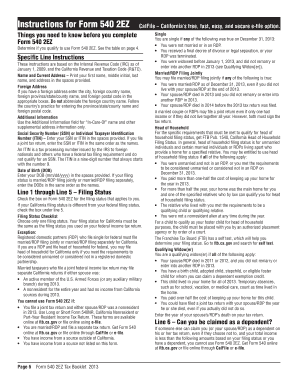

The California Form 540 Instructions 2016 are categorized into different sections to make it easier for taxpayers to navigate through the guide. Some of the main sections include:

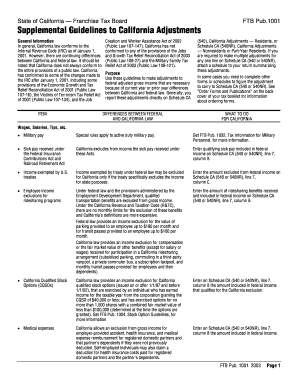

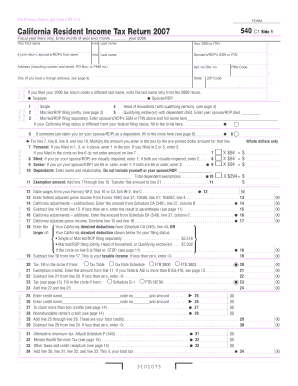

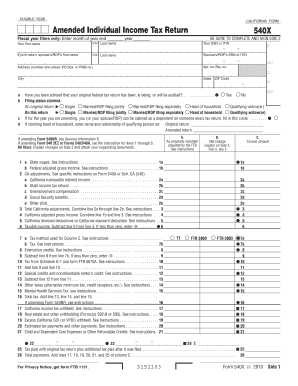

Introduction and general information about Form 540

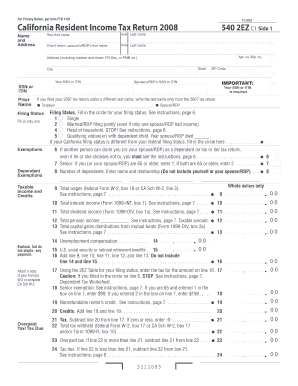

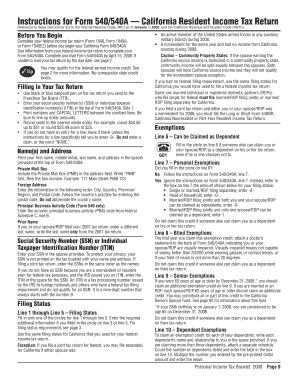

Filing requirements and eligibility criteria

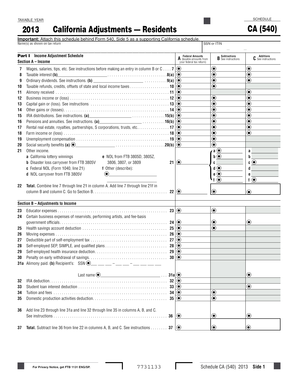

Instructions for reporting different types of income (wages, self-employment income, rental income, etc.)

Details about various deductions and credits available

Guidance on completing specific parts of the form

Information on how to calculate and pay taxes owed

Tips for avoiding common errors and mistakes

Resources for additional help and assistance

How to complete california form 540 instructions 2016?

Completing California Form 540 Instructions 2016 can be done following these steps:

01

Gather all necessary documents, such as W-2s, 1099s, and receipts for deductions

02

Read the introduction and general information to familiarize yourself with the form

03

Carefully review the filing requirements and eligibility criteria to ensure you meet the necessary qualifications

04

Follow the step-by-step instructions provided for each section of the form, reporting your income, deductions, and credits accurately

05

Double-check all calculations and ensure you've included all necessary information

06

Sign and date the form, and include any required attachments or schedules

07

Make a copy of the completed form and all supporting documents for your records

08

File the form by the designated deadline, either by mail or electronically

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.